Connecticut and New York are respectively the second- and third-least-tax-friendly states in the nation, according to the latest annual ranking by personal finance magazine Kiplinger.

Connecticut and New York are respectively the second- and third-least-tax-friendly states in the nation, according to the latest annual ranking by personal finance magazine Kiplinger.

The publication ranks states according to the sum of income, sales, property and gas taxes paid by a hypothetical married couple with two dependent children, an earned income of $150,000, and qualified dividends of $10,000. Illinois was judged the least tax-friendly in the country.

Connecticut’s property taxes are the fourth-highest in the U.S., with the statewide average for a $400,000 home being $8,456 per year. However, residents in such high-income areas as Fairfield County typically pay more than $10,000 in property taxes each year, Kiplinger noted; as mandated by the Tax Cuts and Jobs Act of 2017, such residents”™ federal tax deductions for state and local taxes have been curtailed.

The Constitution State also has the ninth-highest state and local gas taxes in the U.S. at 42.11 cents a gallon, and taxes estates worth more than $3.6 million for anyone who dies in 2019. Connecticut is the only state with a gift tax on assets that are bequeathed before dying.

However, Kiplinger noted, with no local sales taxes, residents pay only the statewide rate of 6.35% (slightly below average) on most of their purchases. Going unmentioned were the new taxes instituted on Oct. 1 for such items as prepared foods and digital services.

Meanwhile, New York “has a hefty income tax bite,” the publication said, noting that both New York City and Yonkers impose their own income taxes, while self-employed people working in the New York City metro area pay a commuter tax.

The average property tax on a $400,000 home in New York is about $7,246 ”“ but again, in some high-cost parts of the state like Westchester County, homeowners pay more than twice that amount.

The Empire State also has an estate tax, which generally is only imposed on that portion of an estate over the $5.74 million (for 2019) exemption. But if the value of the estate is more than 105% of the exemption amount, the exemption won’t be available and the entire estate will be subject to New York estate tax.

In addition, New York”™s cellphone wireless service tax is the fifth-highest in the country, and its gasoline taxes stand at 45.96 cents per gallon ”“ considerably higher than the national average of 31.7 cents per gallon.

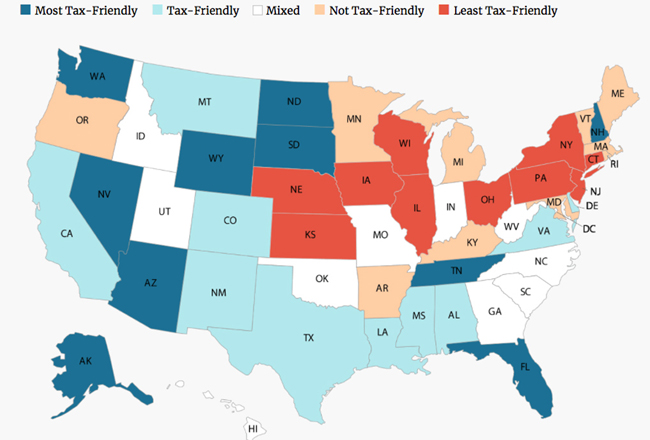

Following Illinois, Connecticut and New York on the least tax-friendly list are Wisconsin, New Jersey, Nebraska, Pennsylvania, Ohio, Iowa and Kansas.

Kiplinger rated Wyoming the most tax-friendly state in the nation. It was followed by Nevada, Tennessee, Florida, Alaska, Washington, South Dakota, North Dakota, Arizona and New Hampshire.