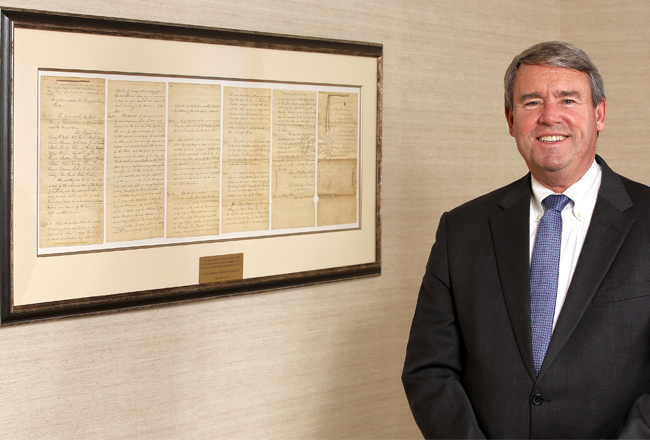

Ask People”™s United Bank President and CEO Jack Barnes how the Bridgeport institution has lasted 175 years and you”™ll get the usual answers: By focusing on its customers. By implementing a prudent acquisitions strategy.

“And by having a little luck,” he said with a twinkle in his eye at his 850 Main St. office.

That twinkle may have had something to do with the head cold he was battling, but it”™s hard to deny that good fortune must play a role in any company, much less a bank, that lasts long enough to celebrate its demisemiseptcentennial ”” 175th anniversary, that is.

People”™s United received its charter ”” a recently discovered copy of which hangs on a wall outside Barnes”™ office ”” on Dec. 24, 1842 as the Bridgeport Savings Bank. (“Starting a bank on Christmas Eve is a little unusual,” Barnes noted.) Throughout the 20th century it operated under various names ”” including both Bridgeport-People”™s Savings Bank and People”™s Savings Bank-Bridgeport ”” and grew in part by acquiring now dimly recalled entities such as Southport Savings Bank in 1955, First Stamford Bank & Trust Co. in 1981 and People”™s Bank of Vernon in 1983. In the wake of that last acquisition, the company became People”™s Bank; in 2007 it became People”™s United to reflect its growth strategy.

“We are looking to expand into other nearby states so we can provide current and new customers with opportunities to experience the superior levels of service that our customers have come to expect,” said John Klein, the bank”™s chairman and CEO at the time of the name change. “Our new name reflects what we have always been — one team, united in its commitment to provide our customers with unparalleled ease, convenience and a consistently superior customer experience.”

Barnes said he was surprised when Klein asked him to stay on after People”™s acquired his employer, Chittenden Corp., a bank holding company headquartered in Burlington, Vermont, in 2008.

“I”™d been involved with smaller integrations” as executive vice president of Chittenden Services Group, Barnes said. “But this was a lot bigger. There was a lot going on. It involved changing over entire systems and the branding, combining two different workforces ”” there were a lot of challenges. But John thought I did a pretty good job.”

Klein died of complications from cancer soon after the deal was completed, with People”™s United CFO Philip Sherringham replacing him. Following two challenging years in the midst of the Great Recession and with People”™s stock price struggling to return to its level of $20 per share at an initial public offering in 2007, IPO”” Sherringham was out. Barnes, who”™d become People”™s senior executive vice president and chief administrative officer after the Chittenden deal, served as interim president and CEO for about three months before officially taking the reins in July 2010.

Today People”™s totals assets are about $44 billion ”“ more than double the $21 billion it had when Barnes took the helm — Â and in October it reported record quarterly net income of $90.8 million for the third quarter. Those results were driven in part by its acquisition of Philadelphia”™s Leaf Commercial Capital and of Long Island”™s Suffolk Bancorp.

Those moves were in keeping with People”™s strategy of growing its regional footprint, Barnes said. The $402 million Suffolk Bancorp deal, which added 28 branches to bring People”™s total to 403, “has given us a pretty darned good presence there” on Long Island, he said.

The Leaf deal helped People”™s boost its national profile, Barnes said, given that the independent commercial equipment finance company has financed nearly $6 billion for more than 243,000 customers across the country. He said the addition of Leaf has helped grow the bank”™s small-business lending practice and the deal has generated “continued momentum” for People”™s United since it closed in July.

Luck played a part in that deal. Barnes said he approached Leaf President and Chief Operating Officer Miles Herman after hearing him speak at a conference. “We had a good talk and not long after that their board members decided to sell ”” and we got the call.”

People”™s remains on the lookout for sensible acquisitions, said Barnes. “As was the case with Long Island, we”™re interested in adjacent markets. We”™ll be looking more toward New Jersey and the Mid-Atlantic states to develop a presence there.”

Barnes also touted the work done by its two People”™s United Community Foundations, which since being established in 2007 have donated about $29.5 million to various causes, with special emphasis on programs and services in low-income areas. In October it made the largest donation in its history, a symbolic $175,000, to Junior Achievement USA, to be divided among seven offices in six states, including Junior Achievement of Western Connecticut in Bridgeport and Junior Achievement of Southwest Connecticut in Stamford.

Other anniversary-themed initiatives include a certificate of deposit offer at 1.75 percent interest; $175 incentives for new checking accounts opened in its locations within Stop & Shop grocery stores; and themed raffles for customers and gifts for its 5,500 employees.

Barnes said that over the next year he hoped to continue making improvements to the bank”™s technological capabilities, launch a revamped customer-facing website and increase the bank”™s digital marketing initiatives.

“We”™re constantly looking to improve all of our products for the customer,” he said. “That”™s what our heritage has been historically and what it will continue to be.”