[vsw id=”VIaWkhLL_5M” source=”youtube” width=”650″ height=”440″ autoplay=”no”]As President Donald Trump approaches the end of his first year in office, the Business Council of Westchester recently gathered a group of experts to make sense of his impact so far in the region.

“Year One of Trump,” held at the Reckson Metro Center in White Plains, featured panels on the Republican president’s foreign policy, tax and infrastructure plans and the growing political divides in the country.

In both tax and infrastructure policy, experts attempted to sort out two still evolving issues in Trump’s early presidency.

TAXES

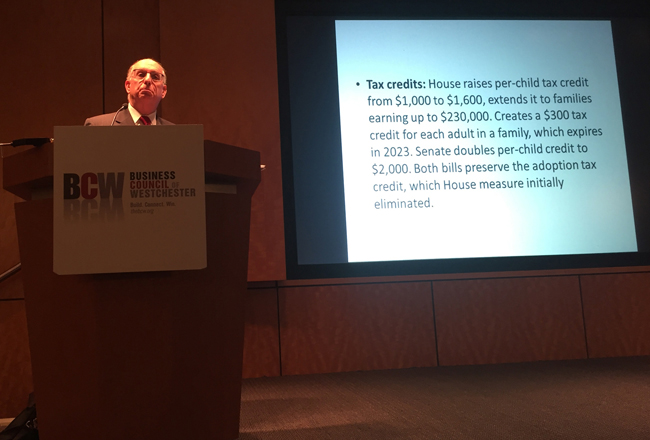

Attorney Glenn Newman, a shareholder at Greenberg Traurig LLP in Manhattan, addressed the GOP”™s Tax Cuts and Jobs Act tax reform bill being considered in Congress as the Business Journal went to press. Newman previously served as president of the New York City Tax Commission and specializes in tax planning involving state and local taxes.

“I can guarantee one thing: The House and the Senate bills as written today are not going to be the tax reform you see,” Newman said, adding that there are differences in the bills that need to reconciled and votes that need to be won.

The Senate and House bills differ even in the number of tax brackets, with the House bill cutting the number of brackets to three and the Senate keeping the original seven.

But Newman pointed to provisions that are consistent through both bills, such as a near doubling of the standard income deduction, coupled with the elimination or limiting of many individual deductions, such as for state and local taxes and the home interest mortgage deduction.

“In order to achieve simplification, they’re going to give a larger standard deduction and fewer specific deductions,” Newman said. “How people come out on that depends a lot on their particular circumstances.” That includes whether persons live in a high tax state and their income level.

The House tax bill caps the mortgage interest deduction at $500,000, though the Senate bill keeps it at its current $1 million. Real estate professionals in Westchester County say the House plan could especially hurt the county’s real estate market, where the median home sale price is $680,000.

That forms a one-two punch with the potential elimination of the deduction for local and state income taxes.

“I would not be surprised to find out that the month of November home sales took a hit because of that,” Newman said. “These changes will affect the economics of home ownership, especially in New York.”

The House tax bill does allow a deduction for state and local property taxes of up to $10,000, while the Senate bill currently eliminates all local deductions.

Newman said the tax bills will put extra pressure on state governments, particularly in Albany and other high tax states. “There’s going to be a lot of pressure on the state governments to reduce the taxes, because it”™s no longer going to be subsidized somewhat by the federal government,” he said.

The position of state governments could be particularly tough, Newman added, because “they are going to want to make up for any lost services from the federal government…by maintaining or increasing taxes, and yet it”™s going to be more of a burden on individuals in the state.”

INFRASTRUCTURE

For the first 12 months of Trump’s term, infrastructure has taken a back seat to health care and tax reform. The trillion-dollar infrastructure bill Trump promised during his campaign has yet to materialize.

But Veronica Vanterpool, the former executive director of the Tri-State Transportation Campaign advocacy group who serves on the Metropolitan Transportation Authority board, said the lack of a bill doesn’t mean there’s no activity. “For those of us paying attention, there’s a lot going on” regarding infrastructure policy, she said.

She said it”™s important to pay particular attention to Trump’s budget priorities.

Positives in Trump’s budget proposal, according to Vanterpool, include $200 billion in direct federal spending for infrastructure projects and expansion of the Transportation Infrastructure Finance and Innovation Act, which provides federal loans for infrastructure projects. New York state used a $1.6 billion TIFIA loan to help finance the Gov. Mario Cuomo Bridge project.

On the negative side, she said, the proposal cuts the federal Department of Transportation overall budget by 12 percent, eliminates federal support for Amtrak and eliminates Transportation Investment Generating Economic Recovery grants, a program from President Barack Obama’s stimulus package that supports local infrastructure projects.

Vanterpool also noted the proposed GOP tax bills eliminate credits for the purchase of electric cars and a $20 monthly deduction for people who commute to work by bike. Most importantly, the House plan eliminates private activity bonds, which provide tax-exempt financing to private development projects. The loss of the bonds could impact Trump’s infrastructure plan, given his emphasis on public-private partnerships, she said.

“That is a really big deal, and it will be unclear how an infrastructure plan would move forward in the absence of these PABs, because public-private partnerships rely very heavily on tax-exempt private activity bonds,” Vanterpool said.

Vanterpool closed by noting the importance of the federal government’s decisions on local transit. The MTA, she said, relies on the federal government for 23 percent of its capital program.

“Whether or not you use transit, whether or not you drive, what happens in transportation affects you,” she said.

And what happens with one mode of transit affects all others.

“Our road infrastructure cannot absorb what’s happening with our transit infrastructure, our bridge infrastructure cannot absorb a collapse in our transit infrastructure, there’s no room for anyone to go anywhere,” said Vanterpool. “So what’s happening at the federal level has direct implications.”

Comments 1