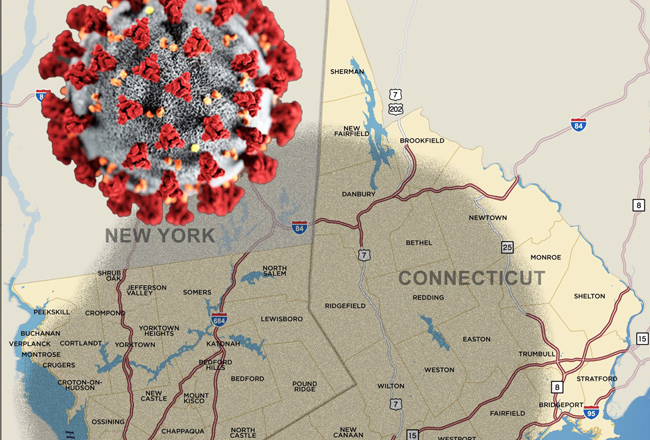

Study: Westchester/Hudson Valley and CT housing markets most vulnerable to COVID-19 turmoil

The housing markets in the Westchester/Hudson Valley region and Connecticut are among the most vulnerable to the economic impact of the COVID-19 pandemic, according to a second-quarter report published by ATTOM Data Solutions, a national property database and data provider.

The report defined the vulnerability based on the percentage of homes facing the potential of foreclosure, along with the percentage of underwater mortgages and the percentage of local wages required to pay for major home ownership expenses.

The report found the East Coast states running from Connecticut through Florida, along with Illinois, were home to 43 of the top 50 counties considered to be most vulnerable to the pandemic”™s economic turmoil.

Westchester, Rockland and Orange counties were among the 11 suburban counties in the New York metro area cited in the report with higher levels of unaffordable housing, underwater mortgages and foreclosure activity.

In Connecticut, five of the state”™s eight counties ”“ Litchfield, Middlesex, New Haven, Tolland and Windham ”“ were also cited.

In regard to homeownership costs ”“ defined in the report as mortgage, property taxes and insurance ”“ Westchester led the nation in the second quarter with 77.1% of average local wage required for major ownership costs. Rockland was second with 71.1% of wages and Long Island”™s Nassau County ranked third at 63.4%.

“Home sales data from around the country is starting to show that eight years of price gains may be coming to an end amid the economic damage flowing from the virus pandemic. It’s still too early to make any definitive calls, but the latest numbers show storm clouds gathering over the market,” said Todd Teta, chief product officer with ATTOM Data Solutions, who added the next few months will provide sufficient data “to tell us how things will most likely pan out.”