Though the year”™s largest lease deal lifted fourth-quarter results in Westchester”™s commercial office market, the county market slipped or showed little improvement in 2011 from the previous year, according to major brokerage firms.

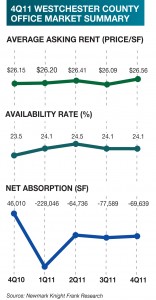

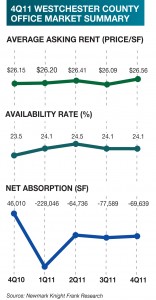

Leasing volume in the county in the last quarter was up almost 50 percent from the third quarter, according to Newmark Knight Frank. But leasing activity for the year was down 20 percent compared with 2010, Newmark Knight Frank analysts said.

Real estate brokerages often differ in their statistical measures of the county”™s office market. Year-to-year comparisons of leasing activity were not available at press time from Newmark”™s largest market competitors.

Cushman & Wakefield Inc. reported approximately 336,800 square feet of class-A and class-B office space leased in the fourth quarter, a 25 percent increase from the fourth quarter of 2010. Compared with the third quarter of 2011, the county”™s leasing volume increased by about 31,000 square feet or 12 percent.

Despite stepped-up activity at year”™s end, 51,990 square feet of class-A space was added to the market in the fourth quarter that was not absorbed in leasing deals, according to Cushman & Wakefield. The county”™s class-B market absorbed about 34,400 square feet of space in fourth-quarter leasing.

Total office space available to lease or sublease in class-A and class-B buildings was at 4.86 million square feet at the end of 2011, almost unchanged from a year ago, according to Cushman and Wakefield.

Cushman & Wakefield said the county”™s overall vacancy rate for class-A buildings was 19.9 percent in the recently ended quarter, compared with 19.7 percent in the fourth quarter of 2010. Vacancies in class-B buildings were at 8.3 percent of overall space at the end of 2011, down from 9 percent a year ago.

CB Richard Ellis put the county”™s fourth-quarter availability rate for class-A space at 20.6 percent of the county”™s total class-A inventory of about 23.85 million square feet of space. Available space in class-B buildings in the fourth quarter was about 11.5 percent of the total class-B inventory of about 7.1 million square feet.

The county”™s average fourth-quarter rent was $27.20 per square foot for class-A space and $22.83 for class-B offices., according to CB Richard Ellis. The White Plains central business district again commanded the highest rates for class-A office space, with an average rent of $31.38 per foot. The county”™s eastern submarket that includes Port Chester, Rye Brook and Rye had the highest class-B rents in the fourth quarter, averaging $29.50 per square foot, and trailed only downtown White Plains in class-A office rates with an average rent of $28.19.

Cushman & Wakefield reported a fourth-quarter average rent of $29.93 per square foot for class-A space and $25.45 for class-B space. The brokerage calculated the average class-A rent in the White Plains central business district at $33.62 per square foot.

CB Richard Ellis reported approximately 616,000 square feet of office space leased in the last three months of 2011, including approximately 516,000 square feet of class-A space. Leasing in the county”™s top-class buildings more than doubled from the third quarter. Fourth-quarter deals accounted for nearly 40 percent of total leasing activity for the year, according to CB Richard Ellis.

In December, landlord RPW Group Inc. closed the year”™s largest new lease at 1133 Westchester Ave. in White Plains, where Westchester’s largest law firm, Wilson Elser Moskowitz Edelman & Dicker, will occupy about 125,000 square feet of space. The law firm in 2013 will relocate across I-287 from about 140,000 square feet of space at 3 Gannett Drive in Harrison.

Newmark Knight Frank said the legal industry accounted for 41.2 percent of total square footage leased in fourth-quarter transactions of 10,000 square feet or greater. The health care industry followed with 15.2 percent of leased space in the quarter.

Newmark Knight Frank said new leases and expansion of existing tenant space accounted for nearly 63 percent of leasing activity in the quarter.