County’s office market still favors tenants

First-quarter office leasing velocity in Westchester County returned to “historical norms” this year after a five-year slump, according to researchers at CBRE. But demand from corporate tenants for large blocks of space was offset by companies shedding large leases, leaving the county with nearly 290,000 square feet of unabsorbed office space in the market at the start of the second quarter.

That office oversupply was much reduced this month when New York Medical College closed on its $17.5 million purchase of 19 Skyline Drive in Hawthorne, an approximately 250,000-square-foot building vacated by IBM Corp. (See Deals & Deeds, page 9.) The purchase by the medical school, which plans to use the building for new programs and to ease crowding in its older campus buildings, relieved the former owner, Mack-Cali Realty Corp., of a vacant property whose leasing for commercial use by multiple tenants would have been “a long slog” in a county where a typical lease deal is under 7,000 square feet, said office broker Howard Greenberg in White Plains. Greenberg called the Hawthorne deal “the biggest news” to date this year in the market.

A veteran tenants”™ broker at Howard Properties Ltd., Greenberg said he saw “a bit of an uptick in demand” at the start of this year. “It has quieted down now significantly,” he said.

“The key to this market is leasing velocity. We”™re always robbing Peter to pay Paul,” as tenants move from one landlord”™s building to another”™s within the county. Greenberg calls it “a zero-sum game.”

Market statistics from CBRE”™s Stamford, Conn. office indicate that trend continued in the first quarter and even increased from a year ago.

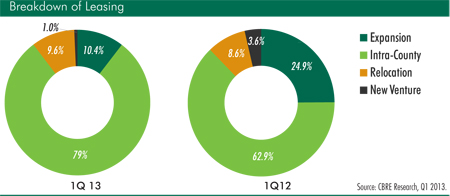

From January through March, tenant moves within the county accounted for 79 percent of leasing, a nearly 10 percent increase from the first quarter of 2012.

Companies relocating here from outside the county this year made up nearly 10 percent of leasing, a 1 percent increase from the same quarter last year.

Office expansions, which accounted for one-fourth of leasing activity a year ago, dropped to about 10 percent this year.

“We”™re back in the tenant-swapping business as we have been,” Greenberg said. “The market is the market and it hasn”™t changed much.”

Yet first-quarter leasing velocity totaled slightly more than 409,000 square feet of office space, a 53 percent increase from the first quarter a year ago. Leasing was 40 percent higher than the county”™s five-year quarterly average, CBRE analysts noted.

Companies seeking blocks of space of more than 20,000 square feet dominated the first-quarter market, accounting for 62 percent of overall activity, according to CBRE. But many of those companies also returned large office spaces to the market at other locations or moved into buildings vacated by companies with large leasing needs.

As just one example of that “good news, bad news” market scenario, Greenberg pointed to the 30,780-square-foot lease signed by Tappan Zee Constructors L.L.C., the bridge-building consortium, at 555 White Plains Road in Tarrytown. Though it was the fourth largest first-quarter deal in the county, the lease offsets only about half of the two floors of offices being vacated in the same building by Bayer Healthcare, he noted.

“There are a lot of large blocks of space that are available with very few big tenants in the market,” Greenberg said. “The 2- or 3,000-footers that are out there now don”™t move the needle much when it comes to occupancy.”

“There”™s no question the amount of large blocks is picking up, certainly in the White Plains CBD (central business district). But there”™s a dearth of demand for large blocks.”

The broker predicted there will be “very aggressive deals offered this year by landlords to fill more of those large blocks.”

That aggressive dealmaking is not limited to large office leases. “As deal velocity is less, every deal becomes dearer and the landlords fight harder for it,” Greenberg said.

CBRE statistics indicate that competition among building owners has stepped up this year.

First-quarter tenant improvement allowances by landlords averaged $37.50 per square foot of leased space, an increase of nearly $7 per square foot from the first quarter of 2012 and about $5.40 higher than the average first-quarter allowance two years ago.

The average first-quarter rent abatement reported by landlords was seven months, up from 5.7 months in 2012 and 3.6 months in 2011.

“It”™s kind of business as usual,” Greenberg said of this year”™s market. “We continue to be a mature suburban economy. We continue to be a tenant-favorable economy and a tenant-favorable real estate market.”

For the rest of 2013, “I pretty much do see more of the same. We”™re still not seeing inbound business from Manhattan or other locations.”