Bank says rapper DMX’s Mount Kisco property part of bankruptcy scheme

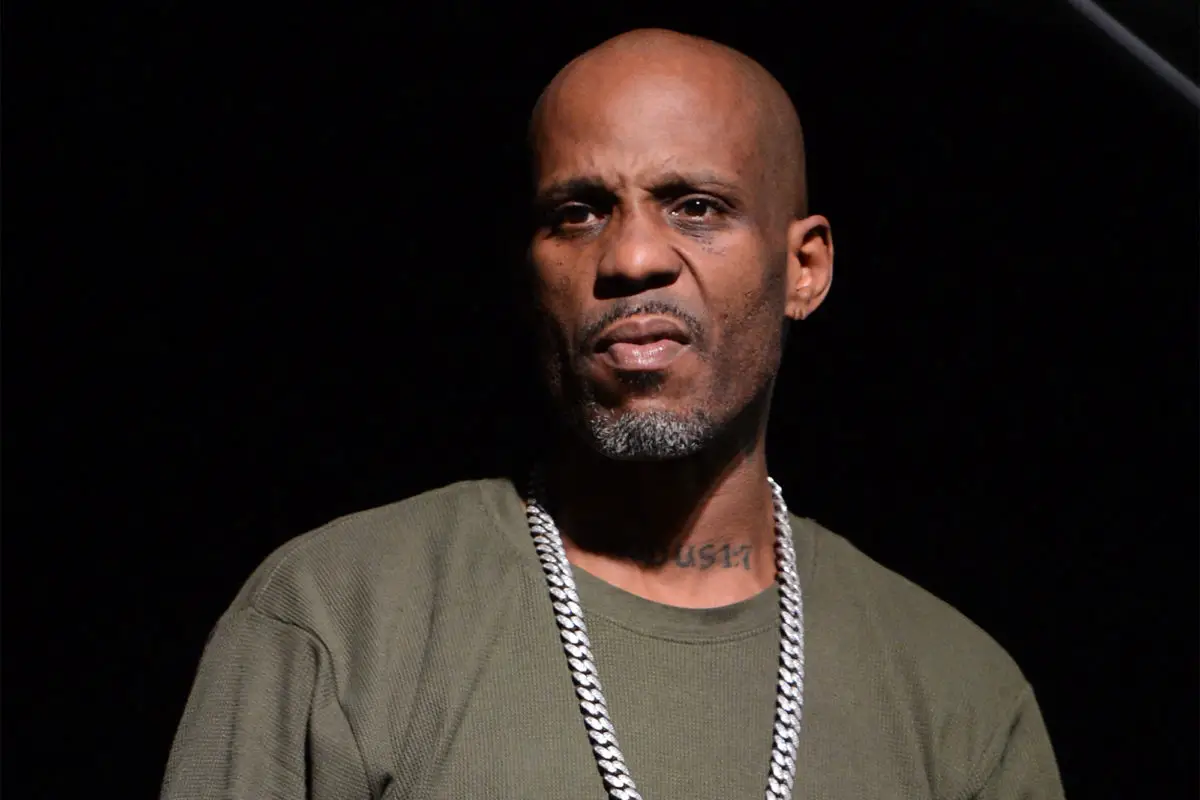

A bank is questioning the legitimacy of a bankruptcy case concerning the house of Tashera Simmons and Earl Simmons ”“ the latter better known as the rapper DMX ”“ that is their seventh bankruptcy in 10 years.

Compass Bank claims that the couple defaulted on a mortgage on a Mount Kisco house and owes more than $900,000. But bankruptcy automatically “stays,” or freezes, most creditors from collecting debts. Compass alleges that the couple has filed multiple bankruptcy petitions to delay a foreclosure sale of their house, granted by Westchester Supreme Court in 2016.

“Access to the automatic stay is a privilege,” Compass states in its pleading. “The debtor has abused that privilege and can no longer be permitted to obstruct Compass”™ state court rights.”

Earl Simmons, 48, was born in Mount Vernon and raised in an abusive home in Yonkers, according to news accounts and court records. He has been arrested many times and struggled with drug abuse.

Simmons embodies contradictions. He is devoted to God and to entertainment, attorney Stacey Richman said last year in a letter to a federal judge. He seeks revelation though “Christ and crack.” He is “the rapper seeking rapture.”

As DMX, he has translated his pain into lyrics and music that moves many people. In 1998, he released two albums that rose to the top of the Billboard 200 chart, the first time a rapper had achieved such a distinction in the same year. He has been nominated for three Grammy Awards, won two American Music Awards, and acted in films.

He also had a habit of not filing income tax returns. In 2017, he was charged with tax evasion, and last year he was sentenced to federal prison and ordered to repay $2.3 million in back taxes. He was released from prison on Jan. 25.

The current case concerns a four-bedroom Colonial on 2.5 acres at 142 McLain St., Mount Kisco. Earl Simmons bought the property in 2000 for $649,000, and the couple mortgaged it in 2003 for $495,000. In 2009, they filed for bankruptcy protection, but the case was dismissed three months later for failure to file required documents.

They petitioned the court again, either together or individually, in 2010, 2013, twice in 2016, 2017 and 2018. In all but one instance, the cases were dismissed for failure to file documents, failure to make payments and other reasons.

Earl Simmons was barred twice from filing new petitions for a while. Last year, Tashera Simmons”™ bankruptcy attorney was barred from practicing in federal bankruptcy court, Southern District of New York, for failure to file documents, attend meetings of creditors or attend court hearings in her case.

On April 3, Tasher Way LLC was registered in Delaware.

On April 4, Tashera and Earl Simmons, as husband and wife, deeded their Mount Kisco property to Tasher Way for $10. Tashera, according to the Westchester County property record, signed for both of them, citing a power of attorney.

Earl Simmons had granted her authority to represent him on real estate transactions, banking transactions, claims and litigation, and tax matters in 2017, two months after he was indicted for tax evasion. But the agreement was not filed with the county until April 4, at the same time that the deed transfer was recorded.

Also on April 5, Tashera Simmons filed the latest bankruptcy action. But the debtor is listed as Tasher Way LLC, of 142 McLain St., Mount Kisco.

Tashera, who filed the petition without an attorney, lists herself as Tasher Way”™s manager, and the document does not say whether Earl Simmons has any interest in the company.

The petition declares that Tasher Way does not own or possess any property, and it lists $0 in assets.

The only liability listed is the Compass Bank mortgage, by its agent, RoundPoint Mortgage Servicing Corp. The petition states that the debt is $980,000, the collateral (the property) is worth $500,000, and no one else is liable for the claim.

Tasher Way was supposed to submit a statement of financial affairs and other documents by Feb. 19. As of May 9, no such documents had been docketed.

Compass Bank says the property is worth at least $835,000. It argues that Tasher Way is part of a scheme of using multiple bankruptcy filings, to invoke automatic stays and defraud creditors.

The bank and its servicing company are asking the court to grant them relief from the stay so that they can pursue their claim in Westchester Supreme Court.