Houlihan Lawrence 1Q commercial report sees coronavirus impacts

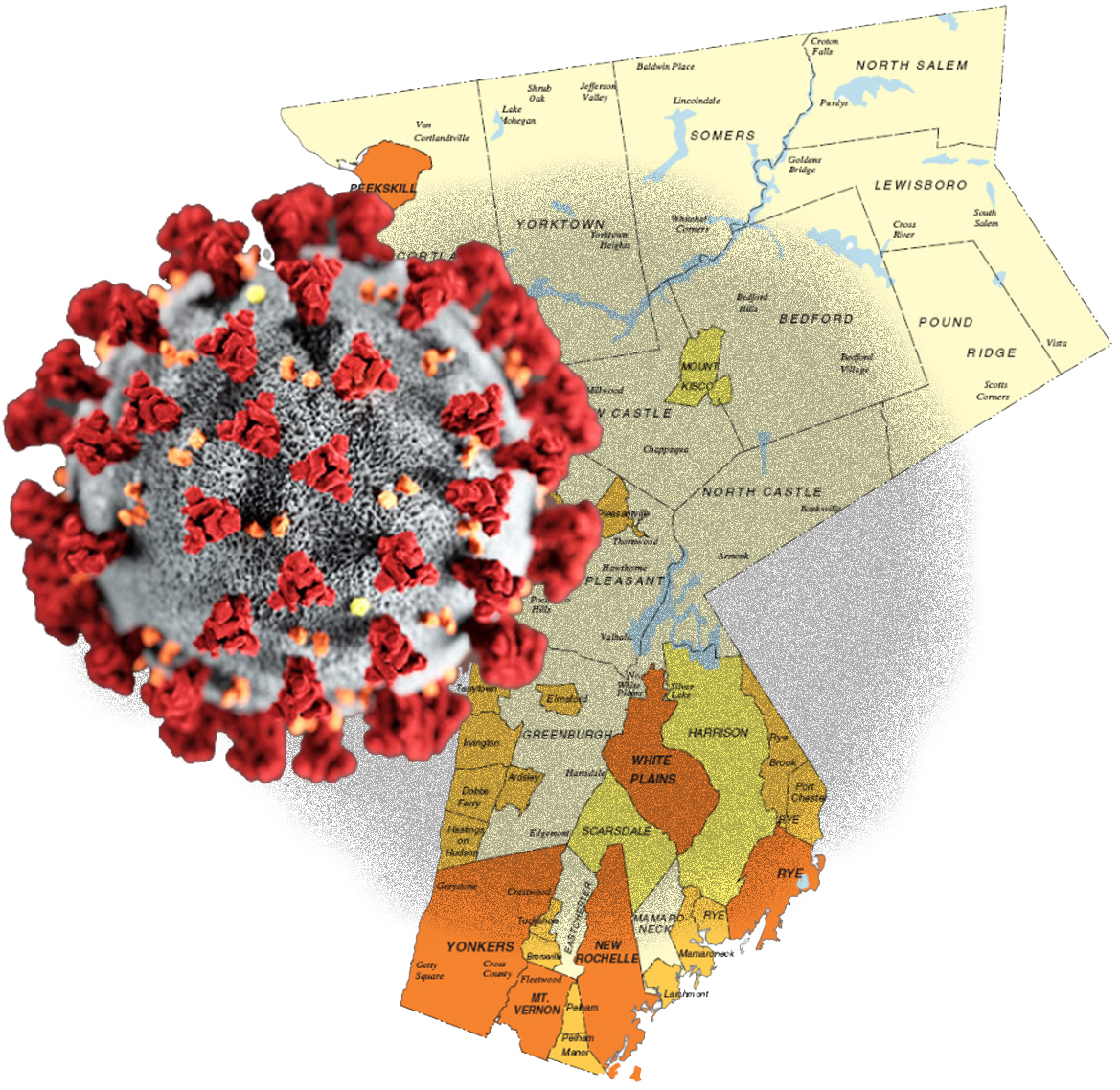

Houlihan Lawrence has prepared its “First Quarter Commercial Real Estate Market Report” for Westchester County and even though the material that was obtained by the Business Journal does not contain a plethora of facts and figures, it is clear that the market was adversely affected during the first quarter by the just-emerging COVID-19 crisis.

It is worth noting that by the end of the first quarter of 2020 the major impacts of COVID-19 were yet to be felt in Westchester although the New Rochelle cluster had appeared and a containment zone was established early in March.

“At the moment, we are still searching to understand the broad ranging impact of the pandemic and necessary business interruptions, hoping for a realistic time line to return to some level of normalcy,” Houlihan Lawrence’s report stated.

“The COVID-19 crisis emerged at a time when Westchester commercial real estate markets were strong and enjoying positive momentum in occupancy and rents. The exception were some retail formats and suburban office space assets that had been experiencing weakness for some time.”

Houlihan Lawrence said that Westchester”™s retail and lodging sectors have been the hardest hit, while Class A office buildings and industrial properties appear better positioned to weather the crisis. The report suggested that multifamily owners will likely face rent concession requests, missed payments and higher vacancies.

The report suggested that retail assets are seeing the deepest impact from the crisis. It pointed to statements issued by Macy”™s and Gap during the last couple of days of the quarter as evidence. Both retailers had announced plans to furlough their workforces totaling more than 200,000.

Houlihan noted that food, not entertainment and personal service retailers had led the way in new leases for many mall, lifestyle and large shopping center assets. These tenants are being hit hard by social distancing measures, the report stated. Some of them operate on thin margins and/or are relatively new businesses. Survival of those that are viable in the long term will require a creative approach by both the landlord and the tenant, the Houlihan Lawrence report said.

Since the imposition of social distancing and work-at-home requirements, shopping malls have shuttered, resulting in a shutoff of revenue streams for retailers not having a strong online presence.

Although not a part of first-quarter results, Houlihan’s report said, “Landlords will likely evaluate the track record of each particular tenant and make decisions with regards to their own strategies and sustainability of the particular business in a post COVID-19 environment. Landlords will likely ‘invest’ in tenants that they deem able to survive, but structure contracted conditions such that their own viability is preserved. Concurrently, landlords may be having a dialog with their own bankers in order to obtain concessions related to their own financing structures.”

Houlihan said that Class A buildings in Westchester had seen strong demand prior to the crisis.

“These buildings tend to have among their tenants, well-established companies including law firms, accounting firms, and even multinational corporations,” the report stated. “While they will not be immune to the crisis and could see some tenants reducing space or even moving to more affordable premises, Class A operations are less likely to be forced into prolonged rent abatement or worse situations.”

Houlihan said that Class B and C office assets in Westchester have a larger number of tenants in the service industries, and/or small businesses, which typically have a slimmer financial buffer. The report said that some of these office building assets need reinvestment and/or will require tenant improvement budgets to re-lease to viable tenants.

The report made note of the Westchester multifamily sector doing quite well over the last five years. Houlihan said that in the near-term Westchester multifamily owners are likely to see a combination of rent concession requests, missed payments, higher vacancies and a readjustment in rents.

“If the county experiences a decline in the number of new households ”“ driven by young tenants being forced to move back home with parents ”“ new projects coming on line in the summer will have a difficult time leasing at the recent historical pro-forma lease rates and occupancy ramp-up anticipated pre-quarantine,” the Houlihan Lawrence report said. “Lease rates will likely decrease until the recovery and hiring return in full.”

The report saw strength in the industrial sector of the market. “Industrial assets may see some disruptions, but these are expected to be less severe as compared to other asset classes,” the report stated.