Xerox ends Fujifilm deal, Jacobson out as CEO

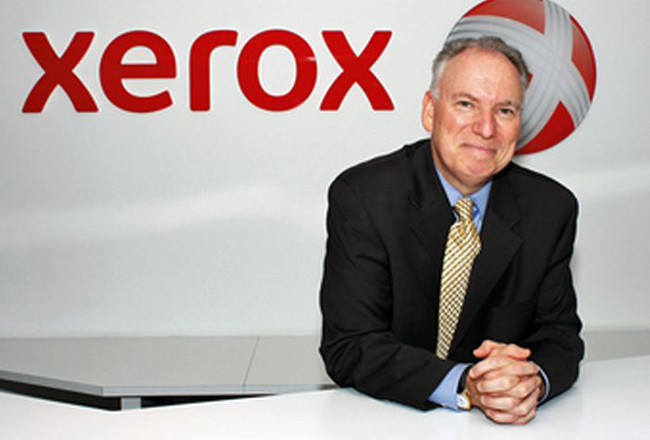

The wild carousel ride involving the $6.1 billion acquisition of Xerox Corp. by Japan”™s Fujifilm Holdings took another surprise turn on Sunday, May 13 with the announcement that the acquisition deal was terminated, CEO Jeffrey Jacobson and Chairman Robert J. Keegan resigned and that a settlement was reached with shareholders Carl Icahn and Darwin Deason meeting their demands of a leadership shake-up in the Norwalk-headquartered company.

In a press statement issued by Xerox, the company explained the transaction was being terminated “due to, among other things, the failure by Fujifilm to deliver the audited financials of Fuji Xerox by April 15, 2018 and the material deviations reflected in the audited financials of Fuji Xerox, when delivered, from the unaudited financial statements of Fuji Xerox and its subsidiaries provided to Xerox prior to the date of the Subscription Agreement and taking into account other circumstances limiting the ability of the Company, Fujifilm and Fuji Xerox to consummate a transaction.”

As a result of this, Xerox quickly entered a new agreement that settled both a pending proxy contest by Icahn and Deason in connection with the company”™s 2018 annual shareholders meeting plus Deason”™s litigation against Xerox and its directors. As part of this settlement, Jacobson resigned his board seat as well as his CEO job and Keegan resigned as board chairman, along with four other directors. Keith Cozza, CEO of Icahn Enterprises L.P., is expected to be appointed as the new chairman of the board and John Visentin, who was announced as the new vice chairman and CEO during a previous agreement between Xerox and Icahn and Deason, will now be able to take on those jobs. Visentin is a former senior advisor to the chairman of Exela Technologies and an operating partner for Advent International, served as Icahn”™s consultant in a proxy battle with the Xerox board.

Xerox enabled the outgoing board to issue a statement that insisted the turnover was designed to avoid instability. “Absent a viable, timely transaction with Fujifilm, the Xerox Board believes it is in the best interests of the company and all of its shareholders to terminate the proposed transaction and enter a new settlement agreement with Icahn and Deason,” the statement said. “Under the agreement, the Xerox Board will be reconstituted to determine the best path forward to maximize value for Xerox shareholders.”

Jacobson had previously been relieved of his duties in early May in return for the cessation of Deason’s lawsuit, only to be reinstated when the Xerox board said Deason failed to drop his lawsuit in a timeline fashion.