State widens $880M business recovery program that has spent only 6%

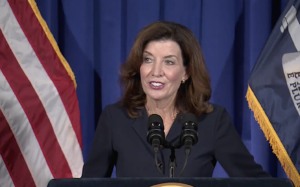

Gov. Kathy Hochul has announced moves to get more of the money in New York state”™s $880 million Small Business Recovery Grant Program into the hands of businesses.

So far only about $48 million, representing about 6% of the available funding, has gone out to eligible businesses.

So far only about $48 million, representing about 6% of the available funding, has gone out to eligible businesses.

One of the changes allows businesses that have revenues of up to $2.5 million to apply for grants. The eligibility limit on annual revenues had been $500,000. In addition, businesses that have received up to $250,000 in loans from the Federal Paycheck Protection Program can now apply for the state grants. That represents a $150,000 increase in the loan limit from the previous $100,000 cap.

Grants for a minimum award of $5,000 and a maximum award of $50,000 are calculated based on a New York state business’ annual gross receipts for 2019. Reimbursable Covid-19 related expenses must have been incurred between March 1, 2020, and April 1, 2021.

The state grants are intended to aid small businesses, micro-businesses and for-profit independent arts and cultural organizations. Micro-businesses are defined as having fewer than 20 employees.

The funds can be used to pay:

- Payroll costs;

- Commercial rent or mortgage payments for property in New York state (but not any rent or mortgage prepayments);

- Payment of local property or school taxes associated with a small business location in New York state;

- Insurance costs;

- Utility costs;

- Costs of personal protection equipment (PPE) necessary to protect worker and consumer health and safety;

- Heating, ventilation, and air conditioning (HVAC) costs;

- Other machinery or equipment costs;

- Supplies and materials necessary for compliance with Covid-19 health and safety protocols;

- Other documented Covid-19 costs as approved by Empire State Development.

“We simply cannot have a full economic recovery if the small business community continues struggling to survive,” Hochul said. “With the Pandemic Small Business Recovery Grant Program opening up to a greater pool of businesses, I strongly urge all the owners who qualify to submit their application so they can access this funding.”

The state says that 2,380 small and micro-businesses in all 10 regions of the state have received grants so far. When the program was announced, the state had said more than 330,000 small and micro-businesses potentially were eligible to receive money.

Empire State Development and Lendistry, the minority-led Community Development Financial Institution based in Los Angeles that was selected to administer the program, is expected to start reviewing new applications on Sept. 8.