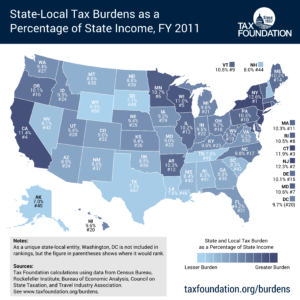

Report: New York has highest tax burden in U.S.

New Yorkers shouldered the largest tax burden in the country in 2011, according to a report released Wednesday by the Tax Foundation, a Washington, D.C.-based policy research organization.

Residents paid 12.6 percent of their per capita income to state and local taxes in 2011, the report said.

New Jersey was ranked second, paying 12.3 percent, and Connecticut came in third with an 11.9 percent tax burden. The national average was 9.8 percent, according to the report.

It may not always be good to be king, but the Empire State defended its crown of most burdened for the third straight year. New York and its neighbors, New Jersey and Connecticut, have occupied the top three spots on the Tax Foundation”™s list since 2005. For 2011, New Jersey ranked second, paying 12.3 percent, and Connecticut came in third with an 11.9 percent tax burden.

“The residents of three states stand above the rest: New York, New Jersey and Connecticut,” authors Elizabeth Malm and Gerald Prante wrote in the report. “These are the only states where taxpayers forego over 11.9 percent of their income in state-local taxes, one half of a percentage point above the next highest state, California.”

The report defined the tax burden based on what residents pay in local and state taxes, not what is collected by state taxing entities. In other words, if a Connecticut resident works in New York City and pays a city income tax, that tax was counted as part of Connecticut residents”™ tax burden, not as part of New York state”™s.

New Yorkers, whose per capita income of $54,000 ranks fifth-highest in the nation, paid $5,258 per capita in taxes to its home state and $1,364 per capita to other states.

Wyoming residents had the smallest burden according to the report, paying 6.9 percent of income in 2011. It was the first time a state other than Alaska ranked as least taxed in several decades worth of reports, the Tax Foundation said.