Tax relief package unveiled in Albany

New York manufacturers would receive income tax credits to offset the high property taxes they currently pay and businesses of all kinds would see their corporate income tax rate reduced to its lowest level in 45 years if the state adopts recent recommendations of a tax relief commission appointed last fall by Gov. Andrew Cuomo.

The state would tap into $2 billion in state revenue realized from budget cuts and cost savings during the Cuomo administration to implement the relief measures for taxpayers.

The commission, led by former Gov. George Pataki and former state Comptroller H. Carl McCall, also recommended a two-year rebate program to cover property tax increases for homeowners in qualifying municipalities that do not exceed the state”™s property tax cap.

Heather C. Briccetti, president and CEO of The Business Council of New York State Inc., called the proposed relief package “a significant, encouraging step forward” to improve the state”™s economic competitiveness. Briccetti served on the seven-member commission that released its final report this month. She said the recommended measures when fully implemented would provide about $500 million in permanent, annual business tax relief.

The commission reported that owners of commercial and industrial properties paid $15 billion, or 30.8 percent, of the real property taxes levied statewide in 2012. An additional $3.4 billion, or 6.9 percent of property taxes statewide, was paid last year by utility companies. Of all taxes paid by businesses in New York, property taxes account for the largest share, 37.8 percent, according to the report.

While asserting that “business property taxes need to be reduced,” the commission also noted those taxes provide local governments with a large revenue base. Rather than a direct property tax reduction, the commission recommended that manufacturers receive a state credit against corporate income taxes that would amount to 20 percent of their annual property taxes. Commission members also suggested a larger credit be considered for upstate manufacturers.

The proposed credit to offset property taxes would provide $136 million in annual tax relief to more than 21,000 manufacturing facilities statewide, the commission estimated.

Commission members also recommended lowering New York”™s “largely outdated and extremely complex” corporate franchise tax and merging it with the banking franchise tax that businesses pay.

Chief among its proposals for corporate tax reform, the commission recommended the corporate income tax rate be lowered from the current 7.1 percent, in effect since 2007, to 6.5 percent, the lowest level for corporate franchise tax rates since 1968.

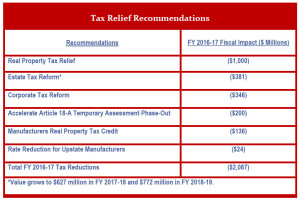

The proposed reduction would take effect in 2015. When fully implemented in the state”™s 2016- 2017 fiscal year, it would reduce corporate tax revenue for the state by $346 million annually, according to the report.

To “kick-start” upstate manufacturing, the commission recommended a historically low corporate income tax rate of 2.5 percent for manufacturers outside the Metropolitan Transportation Authority commuter region. That would additionally reduce taxes by an estimated $24 million among more than 4,300 upstate businesses, according to the report.

The commission also recommended accelerating a scheduled phase-out by 2017-2018 of a temporary state surcharge on home and business utility bills. The energy assessment would be eliminated in 2014 for industrial customers, while all other customers would benefit from an accelerated end to the program. The proposed measure would bring about $200 million in additional tax relief.

“This will immediately improve the business climate for industrial customers where electric power is a significant cost of production,” the commission reported.

To ease the property tax burden on homeowners, the commission recommended a two-year program that ties state rebates for residents to their local government”™s performance in keeping their annual budget within the state”™s 2 percent property tax cap and in sharing and consolidating public services with other municipalities.

The commission recommended an effective freeze on residential property taxes in the form of rebates from the state equal to the increase in a homeowner”™s tax bill. The rebates would only be given to taxpayers whose school districts and local governments have kept any increase in their annual tax levy at or below the 2 percent cap.

Homeowners would qualify for a second-year rebate to offset hikes in their property tax bills if their local governments or school districts again stay within the tax cap and also develop a plan for shared services and administrative consolidations with other districts or municipalities.

The commission said the two-year rebate program when fully phased in would provide $976 million in tax relief to nearly 2.8 million homeowners.

Addressing estate tax reform, the commission recommended raising the exemption level for taxation from New York”™s current $1 million estate value to the current federal level of $5.25 million and indexing it for inflation. Commission members also recommended lowering the state”™s highest estate tax rate from its current 16 percent to 10 percent.

The commission said those changes “would exempt nearly 90 percent of all estates from the imposition of the estate tax, protect family farms and small businesses and eliminate the incentive for middle-class and wealthy New Yorkers to leave the state to avoid the tax.”

Pataki in a statement accompanying the release of the report said, “Governor Cuomo asked us to focus on real property taxes and we did, delivering a robust program that will provide real relief to middle class taxpayers and especially those on fixed incomes ”¦The Commission worked overtime to deliver our recommendations today and I”™m proud of the package we”™ve assembled.”