Small businesses stay off state health exchange

The New York State of Health insurance exchange this month began a three-month open enrollment period for its second year of operation after signing up nearly 1 million individuals for health care coverage in the new state marketplace in 2014.

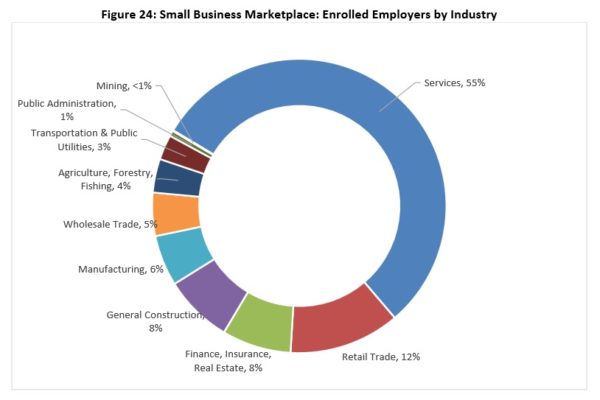

Small businesses in Westchester County and across the state, though, did not rush to purchase group plans for their employees on the state”™s Small Business Health Options Program marketplace, or SHOP.

A statewide total of 3,106 businesses with 50 or fewer employees enrolled with insurance carriers offering plans on the exchange. Those businesses enrolled just under 9,800 employees statewide.

In Westchester County, 323 employees were covered in 2014 on group plans purchased on the exchange. Of those, 228 employees, or 71 percent, are insured by a fast-growing and expanding nonprofit player in the market, Health Republic Insurance of New York. Only one other insurer, Oxford ”” the market”™s dominant insurance carrier ”” offered plans on the exchange for Westchester businesses.

Health Republic is the state”™s only Consumer Operated and Oriented Plan, or CO-OP, which are member-governed health insurance companies created nationwide under the Affordable Care Act to increase market competition. James P. Schutzer, an insurance broker and vice president of J.D. Moschitto & Associates Inc. in White Plains, said Health Republic has enrolled about 150,000 members in 2014, “which is tremendous for a new player.”

Speaking at a Business Council of Westchester forum in Tarrytown, Danielle Holahan, deputy director of New York State of Health, said Oxford is leaving the exchange in 2015. The move affects 416 employer groups, she said.

Holahan said the state has implemented a streamlined renewal process for individuals and businesses enrolled on the exchange. “There”™s minimal change in the product offerings from last year, and that”™s intentional,” she said.

Schutzer said it was business as usual in 2014 for most small businesses providing group coverage. “For our business in general, there wasn”™t a major shift in how employers went about buying their insurance for their employees,” he said. Schutzer is president of the New York State Association of Health Underwriters.

New York officials have set a goal of 1.1 million enrollees in the state marketplace by the end of 2016. Schutzer said that target includes 600,000 enrollees in the individual marketplace and 415,000 employees in SHOP.

“They”™re close to that 1.1 million number, but they”™re way off on the SHOP numbers,” he said. For small-business owners, “Ultimately there were better options off the exchange.”

Schutzer said a small-business tax credit for SHOP enrollees “is the primary reason to be on the exchange.” But many companies don”™t qualify for the credit, he said.

Schutzer said the exchange sets no minimum participation requirement by employees at businesses offering group coverage, another major reason for businesses to shop in the state marketplace. “Although it was attractive, it wasn”™t attractive enough to move the needle off the SHOP,” he said.

“We”™re trying to educate businesses about the SHOP so they”™re aware it is a viable option out there. There”™s not a major change this year,” Schutzer said.

Another new player in the Westchester market is CareConnect, the insurance business of North Shore-LIJ Health System. North Shore-LIJ this year negotiated agreements to become the parent company and co-operator of Phelps Memorial Hospital in Sleepy Hollow and Northern Westchester Hospital in Mount Kisco.

CareConnect last month announced that it has added the 334-physician Mount Kisco Medical Group and the 2,915-physician Montefiore Health System to its provider network, CareConnect Alliance Partnership, as it expands into Westchester County and the Bronx. CareConnect, whose downstate provider network includes more than 14,000 physicians, will offer health care plans both on and off the state exchange during the current enrollment period that ends Feb. 15.

Schutzer said privately owned heath insurance exchanges are increasingly competing with the public exchanges mandated by the Affordable Care Act. “The exchange model itself ”” which is about choice ”” there are companies privately that are doing that,” he said. “So the concept of the exchange is resonating with businesses.”

Schutzer said the private exchange business “is going to grow substantially over the next several years.”