Stress test, family-business style

In mid-May, federal regulators set out new rules under which they would subject the nation”™s largest banks to “stress tests” of their assets and liabilities.

In mid-May, federal regulators set out new rules under which they would subject the nation”™s largest banks to “stress tests” of their assets and liabilities.

If there is no stress test quite like that of the small family business, those entities should add a formal process for testing the ability of their partnerships to stand up to court scrutiny when the day arrives that control passes to the next generation, according to Todd Angkatavanich, an attorney with Withers Bergman L.L.P., which has offices in Greenwich, New Haven and New York City.

Angkatavanich spelled out 10 “stress tests” family businesses can employ, speaking at the Transitions East conference in April hosted by Stetson University and Family Business Magazine, with the Westport-based Mitchell”™s Family of Stores CEO Jack Mitchell also a featured speaker.

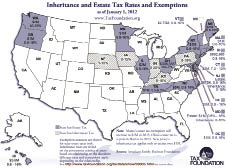

The conference arrived even as the National Federation of Independent Business and other groups warn of continued uncertainty over where Congress will peg estate taxes when the current law expires at the end of this year, at which point the federal estate tax is set to revert to a 55 percent rate with a $1 million exemption.

“We”™re basically talking about a lifetime audit or a lifetime stress test if you will, of your family limited partnership,” Angkatavanich said at the conference in a live interview with Trusts and Estates posted online. “Over the past 10 years ”¦ a lot of the recent cases made it clear that you can”™t just set up these documents, make them legal and then put them into a drawer.

“The notion with doing a diagnostic stress test is to say, ”˜Okay, you have a partnership,”™” he said. “It”™s been in place for whatever ”“ five years, 10 years, 15 years. The parent is still alive and well ”“ let”™s do a checkup from time to time rather than waiting until the parent passes on and scrambling to see whether this thing was administered properly. The name of the game with these vehicles now is for them to pass scrutiny; you have to have these things administered properly, at a minimum.”

In 2010, Connecticut lowered the minimum asset base at which taxes kick in for estates, with critics saying the new rules could impact family businesses that are bequeathed to the next generation. With two months to go in the fiscal year, estate tax collections were running a third below their level in fiscal 2011 ”“ which could be due to any number of factors, from tax avoidance to the death of one or more exceptionally wealthy people the previous year having an impact on this year”™s comparisons.

According to Angkatavanich, the Internal Revenue Service has been scrutinizing family partnerships the past few years with an eye on ferreting out whether a parent truly cuts ties with an asset after handing it to their children in their lifetime, or whether they still benefit from that asset and so retain an implicit interest. It is something that only a legal “stress test” can determine.

Bona fide gifts or sales that have met any tax obligations are completely legitimate, of course, but some family partnerships may toe the line a little too closely.

“You want to see where there are some of the telltale (signs) that the parent has retained an implied use of the asset, whether they”™ve continued to take cash flow directly from the asset ”¦ whether they continued to use some of the assets without paying rent,” Angkatavanich said.