Report measures shift in preferences of region’s home buyers

In the decade since the 2008 financial crisis brought the country”™s worst economic downturn since the Great Depression, real estate professionals say behaviors of the typical homebuyer in New York City”™s northern suburbs have shifted.

Today”™s buyer in Westchester County, along with Fairfield County and the Hudson Valley, is more likely to be cautious. They’re more often willing, according to a recent market report, to give up square footage or acreage to be in more convenient communities with access to transit.

The changes are documented in a report from Houlihan Lawrence titled “Ten Years From The Financial Crisis: A Shifting Definition of Value.”

“Ten years ago, I think buyers were working in fear of losing a home, of having too much competition out there just to get a house,” said Barry T. Graziano, a branch manager and associate real estate broker in Houlihan Lawrence”™s Armonk office. “Today”™s buyer is a little bit more prepared. They”™re looking at a lot of data, looking at inventory, at multiple homes and are looking for that key-ready home with everything they need. They”™re not in such a rush anymore.”

The report also analyzed data on where the region is finding its buyers. Overall, the demographics of buyers in 2017 are similar to 2009. About 60 percent are buying within their community, close to a quarter are coming out of New York City and between 5 percent and 10 percent from out of state or abroad. One noticeable change is a jump in buyers from Brooklyn, even if the borough”™s transplants remain overall a small part of the market. Just 2 percent of buyers in the northern suburbs came out of Brooklyn in 2009. Last year, the number had tripled, with 6 percent of buyers coming north from Brooklyn.

The report also analyzed data on where the region is finding its buyers. Overall, the demographics of buyers in 2017 are similar to 2009. About 60 percent are buying within their community, close to a quarter are coming out of New York City and between 5 percent and 10 percent from out of state or abroad. One noticeable change is a jump in buyers from Brooklyn, even if the borough”™s transplants remain overall a small part of the market. Just 2 percent of buyers in the northern suburbs came out of Brooklyn in 2009. Last year, the number had tripled, with 6 percent of buyers coming north from Brooklyn.

Graziano said New York City buyers in general have sought transit-oriented locations in southern Westchester, for easier access to Manhattan, as well as areas with walkable neighborhoods.

The report was released following a third quarter during which the Westchester County residential market showed a slight decrease in overall sales and flat median prices.

There were 3,022 residential sales of single-family homes, condominiums, cooperatives and two- to four-family buildings in Westchester County during the quarter, marking a roughly 5 percent decrease compared with the same period last year, according to a market report from the Hudson Gateway Association of Realtors.

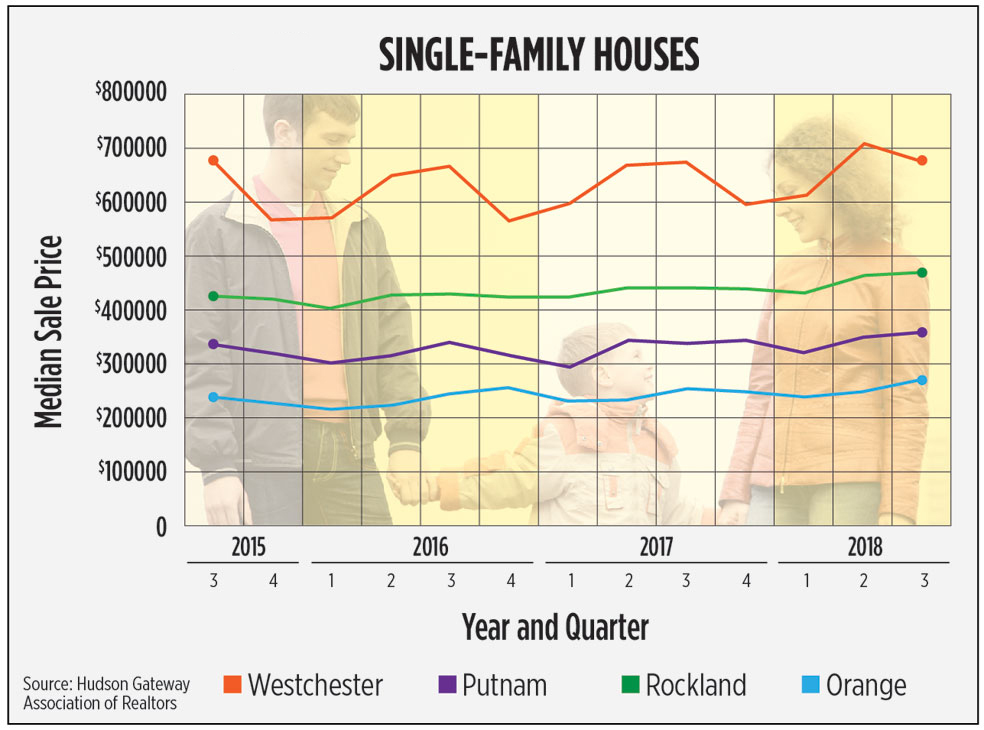

Median sale prices stayed relatively flat, as measured by HGAR. Westchester”™s median single-family home sale price of $679,000 was down just a tenth of a percent from the same point last year.

“As of the third quarter, it does not appear that the tax reform law passed earlier in the year has had a material effect on sales, nor have gradually rising mortgage interest rates,” the HGAR report concluded. “While both could manifest an influence at a later date, the housing market in the lower Hudson Valley currently remains strong.”

In its quarterly report, Better Homes and Gardens Real Estate Rand Realty said if there is an impact of tax reform to be found, it”™s on the higher end of the market in Westchester. Weaker demand for

high-priced homes could be, the report said, “increasing the percentage of lower-priced homes in the mix of properties sold and thereby suppressing price appreciation.

“That would explain why, for example, average prices are increasing dramatically in the lower-priced condo (up over 5 percent) and co-op (up almost 4 percent) markets, as well as the more affordable neighboring counties.”

Houlihan Lawrence’s luxury market report found home sales of $2 million and above are down about 2 percent year over year.

HGAR reported sale price growth in Westchester”™s neighboring Hudson Valley counties. The median sale price for a single-family home in Rockland County reached $475,000, up 6.7 percent from last year. In Putnam, the $360,000 median sale price was up 5.9 percent, and in Orange County the median sale price of $275,000 for a single-family home was up 7.8 percent from a year prior.

The standout market for Westchester may be small multifamily buildings, according to numbers reported in the Elliman Report, a quarterly market analysis from Douglas Elliman Real Estate.

Elliman reported 160 separate sales transactions for two- to four-family homes from July to September, up about 28 percent from the same time last year, and 18 percent from last quarter. The median sales price for the small multifamily properties climbed 12 percent from this point last year to $525,000.

Nino Gjeloshaj, a real estate agent with Douglas Elliman, said demand remains strong for rental properties, attracting investors.

“The people that are looking to buy, they don”™t just buy because they like the area and have done research, they actually live in the area for a year or so, then look to purchase,” Gjeloshaj said. “That drives the rental market, and the rental market increases the value of those properties.”