Report: Cost for employer health plans stable, still out of reach for many

As premium increases in the health insurance exchanges dominate the political conversation, a report by the Kaiser Family Foundation found costs for employer-sponsored plans to be rising at a lower, relatively stable rate for the past five years.

However, the overall cost is substantial enough that half of all small firms did not offer health benefits to employees this year.

Average annual family payments for employer-sponsored health plans increased 3 percent to $18,764 this year, according to Kaiser”™s annual Employer Health Benefits Survey that was released in September. The yearly poll of employers is done in partnership with the Health Research & Educational Trust, the research affiliate of the American Hospital Association.

Average annual family payments for employer-sponsored health plans increased 3 percent to $18,764 this year, according to Kaiser”™s annual Employer Health Benefits Survey that was released in September. The yearly poll of employers is done in partnership with the Health Research & Educational Trust, the research affiliate of the American Hospital Association.

The survey was conducted between January and June and included just under 4,000 randomly selected firms with three or more employees.

The average premium for employer-sponsored single coverage increased 4 percent to $6,690.

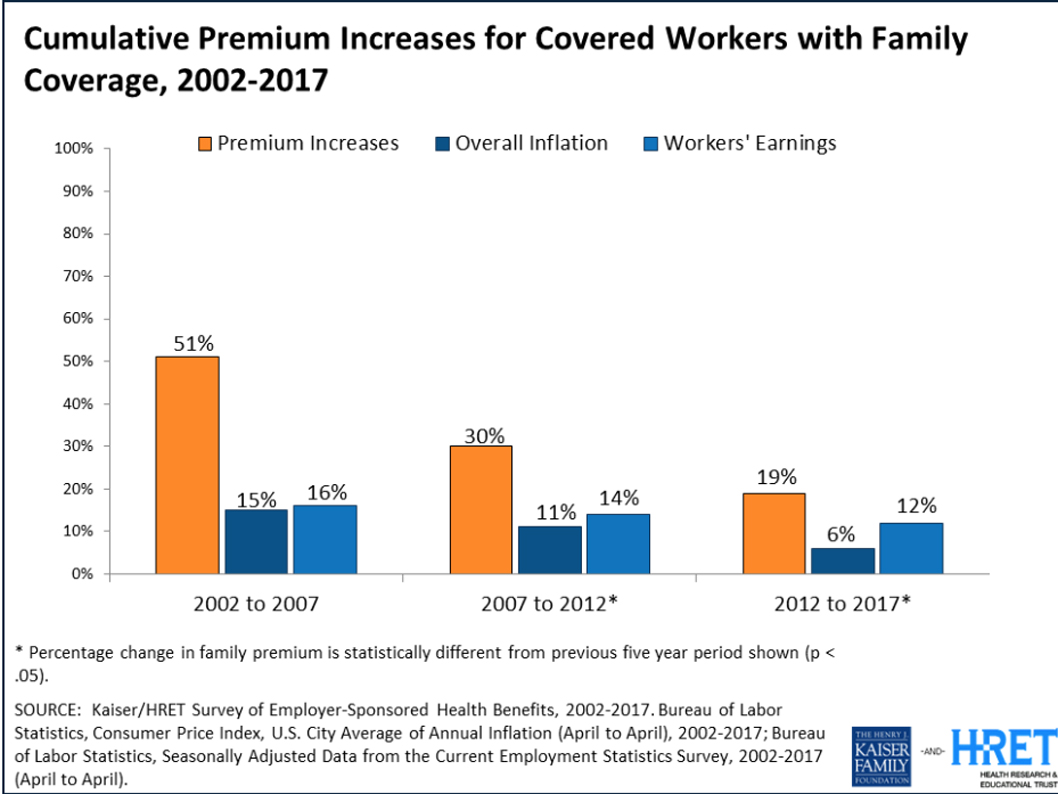

The findings mark the sixth straight year that premiums for employer-provided policies have increased by less than 5 percent. Since 2012, average family payments have increased 19 percent, according to the survey. That”™s far slower than the increases between 2007 and 2012, 30 percent and 2002 and 2007, 51 percent.

Kaiser Family Foundation President and CEO Drew Altman said in a statement that premium increases for employer-sponsored care are “far less than the 20 percent average in the Affordable Care Act marketplaces. While the marketplaces seem to get all the attention, the much larger employer market where more than 150 million people get their coverage is very stable.”

In a webcast press conference following the report”™s release, Altman called the slowed growth in premium costs for employer-sponsored plans “health care”™s greatest mystery,” with no clear underlying cause.

Still, premiums grew at a faster rate over the past five years than worker earnings and overall inflation. Altman noted that separate Kaiser data found 30 percent of people surveyed expressed concern about paying medical bills.

“If this is the new normal, it”™s not a normal people are happy with,” he said.

In New York, 50 percent of residents receive insurance through an employer, according to 2016 numbers kept by Kaiser, compared with 49 percent nationally. Medicaid, the next largest source of insurance for New Yorkers, covers about a quarter of the state”™s residents.

While employers still cover the majority of premium costs, the share an employee contributes has increased over the past five years, according to the study.

Workers on average contribute $5,714 annually toward health care premiums for family coverage, which is up 32 percent from average 2012 employee contributions.

The average annual deductible for single coverage is $1,505 in 2017, just slightly up from a year earlier.

Altman described increasing out-of-pocket costs, such as higher deductibles, as a “fallback cost containment strategy” for employers in recent years.

“We should watch whether growth in deductibles is reaching some natural limit or we”™re just seeing a one-year pause,” he said.

The report did not paint a rosy picture for health coverage at small firms. Workers in small firms are less likely to be offered health benefits and likely to pay more for coverage they are offered.

The survey found just half of firms with fewer than 50 workers offered health plans in 2017, down from 59 percent in 2012. The Affordable Care Act requires all companies with 50 or more full-time employees to offer health insurance or face a tax penalty. The Kaiser survey found that 99 percent of firms with 200 or more employees offered health benefits.

Among small firms that did not offer health benefits, 44 percent said the decision is driven by high cost, while 17 percent said their firms are too small.

The survey did find that 16 percent of firms not offering health coverage offered workers money to buy a plan of their own. But only 2 percent of small firms not offering coverage said they chose not to because they believed employees would get a better deal on the individual exchange.

Small firms tend to pay lower wages, Altman said, adding that “while the rate of increase may have slowed down, the number, the cost, is just high. So it”™s a struggle for them.”

Workers in small firms contribute on average $1,550 more annually for family health care premiums than those at large firms. Deductibles tend to be higher as well. Workers covered in preferred provider organization plans at small firms, for example, face an average family deductible of $3,660, almost double the $1,899 average deductible for the same plans at large firms.