Yorktown’s Blue Book employees get steeply discounted $750,000 settlement

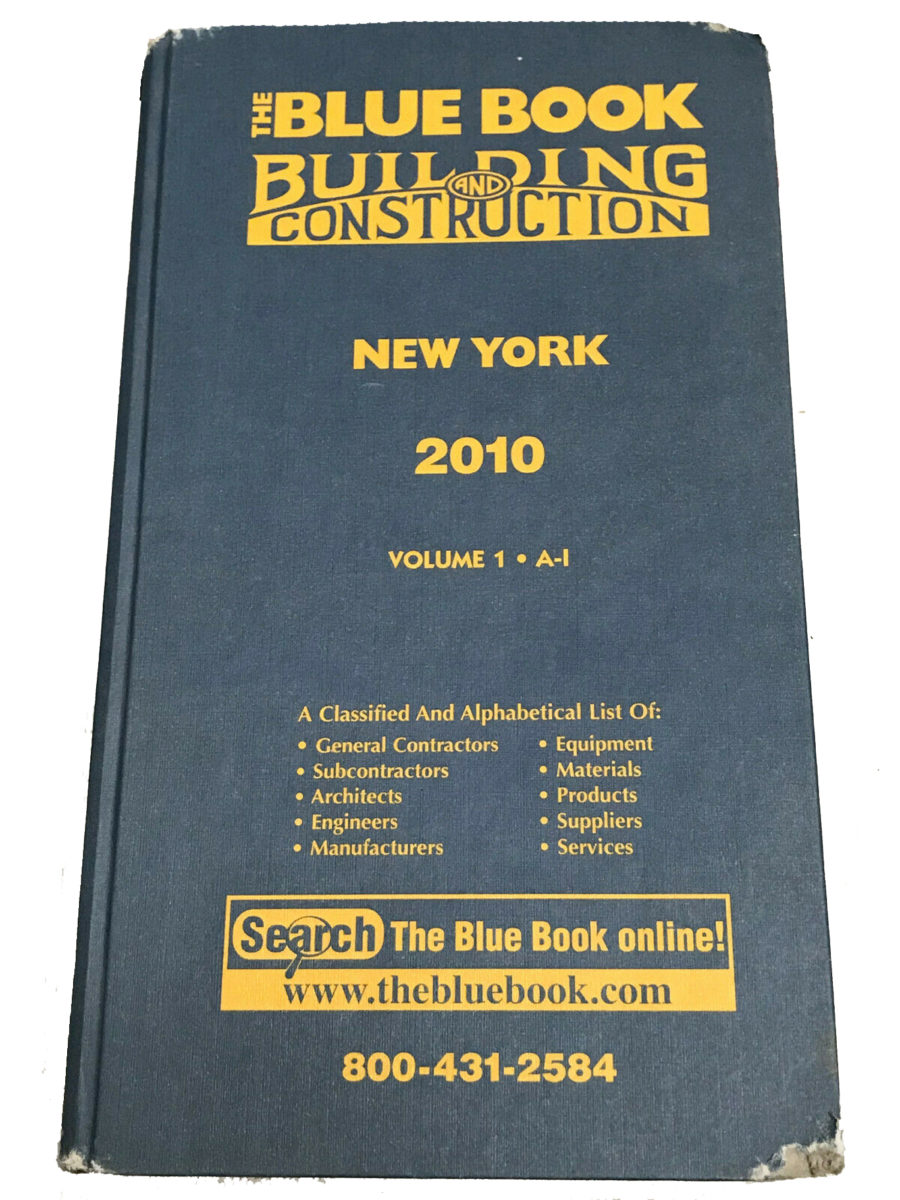

A financial consultant has agreed to pay the employee-owners of the Blue Book of Building and Construction ”“ a kind of Yellow Pages for contractors ”“ $750,000 to settle charges that the company was drastically overvalued.

In 2012, James O”™Malley, owner of Contractors Register, the Yorktown publisher of the Blue Book, decided to sell his company to the employees. He hired Professional Fiduciary Services of Milwaukee to establish the price and put together an Employee Stock Ownership Plan.

In 2012, James O”™Malley, owner of Contractors Register, the Yorktown publisher of the Blue Book, decided to sell his company to the employees. He hired Professional Fiduciary Services of Milwaukee to establish the price and put together an Employee Stock Ownership Plan.

Professional Fiduciary Services valued the company at $26.7 million.

The U.S. Department of Labor sued Professional Fiduciary Services in 2019, alleging that the consultant had used blatantly unrealistic projections to establish the selling price, causing the employees”™ plan to “overpay by tens of millions of dollars above fair market value.”

Secretary of Labor Eugene Scalia agreed to settle the dispute for far less, according to a consent order filed Jan. 12 in U.S. District Court, White Plains “because PFS has established a financial inability to pay the losses.”

PFS had hired Prairie Capital Advisors to establish Blue Book”™s fair market value. Prairie, according to court filings, accepted Blue Book”™s financial information without independently verifying the numbers.

The numbers inflated Blue Book”™s value. The four-year compound annual growth rate was pegged at 0.4%, for instance, even though Blue Book advertising was being disrupted by internet competitors and in the previous two years growth had fallen to a negative 10.5%.

Prairie also signed off on a sales growth rate of 2.2% for five years, followed by 6.3% for the next five years, without explaining how the growth could be achieved.

The Department of Labor held PFS responsible for accepting Prairie”™s valuation without questioning blatant errors, because PFS had a duty to act solely in the interest of the employee plan and its beneficiaries.

PFS was accused of violating its fiduciary duties and engaging in a prohibited transaction.

The Labor Department also assessed a $150,000 penalty but waived the fine because Scalia determined it would cause PFS severe financial hardship. But PFS will have to pay more to the employee plan if its income exceeds 2019 income by more than 30% in any of the following three tax years.

PFS”™ owner John Michael Maier also agreed to restrictions on his work with employee stock ownership plans.