Internet complaints lead state’s top 10 consumer frauds

For 12 years, internet complaints have led the New York state attorney general”™s annual list of top 10 consumer frauds.

For 12 years, internet complaints have led the New York state attorney general”™s annual list of top 10 consumer frauds.

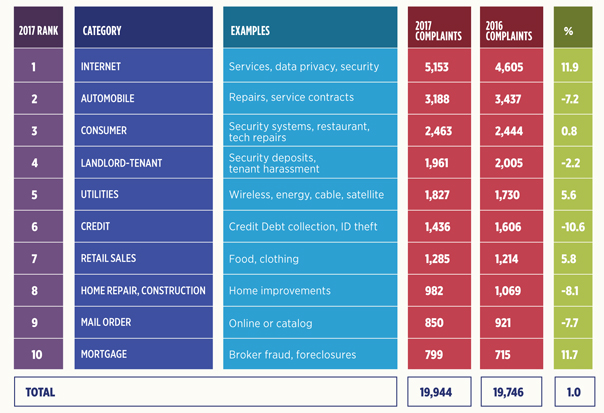

Internet complaints increased by nearly 12 percent last year to 5,153.

The dark side of the internet can be seen as evidence of the growing and far-reaching impacts of digital technology on 21st century life.

The category includes problems ranging from the annoying to the alarming: slow internet performance, spam, free speech issues, privacy, spyware and malware, security threats, identity theft, consumer frauds, cyberbullying and distribution of child pornography.

Consumer fraud complaints increased by 1 percent overall to 19,944, according to Attorney General Eric T. Schneiderman.

An old technology, automobiles, ranked second in consumer fraud. Complaints declined by 7 percent, but still accounted for a hefty 3,188 cases, including buying, leasing and renting cars, as well as repairs and service contracts.

The state”™s Lemon Laws offer some remedies. Customers might be able to get full refunds if a car doesn”™t conform to the warranty or the dealer is unable to repair defects.

Schneiderman has sued several auto dealers for using deceptive sales tactics, such as “jamming” bogus anti-theft services on unsuspecting customers. He said he has negotiated 14 settlements statewide, including several in Westchester County, that have resulted in $19 million in penalties since 2015 and restitution to nearly 29,000 customers.

Consumer services ranked third with 2,463 complaints, including services such as home repairs, security systems, catering, tech repairs, snow removal and party planning. Customers are urged to get estimates from at least three vendors, check with the Better Business Bureau, check references and clearly define obligations and restrictions in a written contract.

Landlord-tenant disputes ranked fourth with 1,961 complaints. A state tenant harassment task force has investigated landlords and management companies that use construction to harass tenants. Sometimes work is done without a permit or in violation of a stop-work order. Sometimes landlords ignore requirements to protect tenants from lead and asbestos

during renovations.

Utilities ranked fifth with 1,827 complaints about landlines and cellular phones, energy and cable and satellite services.

Hefty cancellation fees on long-term wireless plans were a common complaint. Customers who are unsure of which plan best fits their calling habits or who want to avoid a large termination fee should avoid extended contracts.

Credit disputes ranked sixth with 1,436 complaints concerning debt collections, credit card bills, debt settlement, credit repair, credit agencies and identity theft.

Consumers should understand that debt collectors may not harass them or provide misleading information by pretending, for example, to be a government agency. Consumers have the right to demand verification of debt.

Retail sales ranked seventh with 1,285 complaints. These include any goods for personal household use, such as food, clothing and rent-to-own products.

Merchants are required to post their refund policies. Customers should be careful with “final sales” or “cash-only final-sales” notices that allow little or no recourse if the merchandise is defective.

Home repairs and construction ranked eighth with 982 complaints for shoddy work and work not done.

Customers should shop for estimates and check with neighbors, suppliers, banks and the Better Business Bureau for references. Never pay the full price up front, the attorney general advised. Customers should insist on a written contract that includes the price, description of work and a payment schedule tied to specific stages of the job.

Mail order problems, including online and catalogs, ranked ninth with 850 complaints.

Consumers should make sure the company lists a real address, not a P.O. box, and has a customer service line.

Mortgage issues ranked 10th at 799 complaints, including mortgage modifications, broker fraud and foreclosures.

Beware of offers that claim to stop or delay foreclosure payments for an upfront fee or to make payments on your behalf, the report states. Watch out for companies that imply they are affiliated with government or work with attorneys but don”™t provide legal services.

The attorney general”™s homeowners”™ protection hotline ”“ 1-855-466-3456 ”“ can connect homeowners to free mortgage assistance services.

Schneiderman also singled out schemes that did not make the top 10 list.

In the IRS scam, the caller poses as a U.S. Treasury or IRS official, demands payment for unpaid taxes and threatens arrest if the money isn”™t paid. They often use fake government logos in emails or spoof caller ID to display “Internal Revenue Service.”

The IRS, the attorney general said, never demands immediate payment or payment information over the phone.

In the grandparent scam the caller claims to be a grandchild in urgent need for money, begs the grandparent not to tell the parents and instructs the grandparent to wire money or buy a gift card for them.

In the student debt scam, a phony company, often using a name that sounds like a government agency, claims it can lower or eliminate debt for a fee. Students should contact their loan servicer themselves to see if any relief

is available.

One type of fraud surpassed even internet complaints and will be discussed in a separate report. A health care fraud hotline recorded 5,565 complaints last year. The attorney general secured nearly $2 million in restitution and savings for incorrect medical billing, claims rejections and failures to process insurance claims properly.

Consumer complaints can be filed at https://forms.ag.ny.gov/CIS/consumer-complaints.jsp or by calling 1-800-771-7755.