Tesla’s new take on solar, old hat for Dutchess company

When Elon Musk unveiled a new solar roof concept Oct. 31 for his SolarCity company, which offers photovoltaic panels integrated into actual roofing tiles for a home or business, it created serious buzz in the energy industry and beyond. But, for one company in Dutchess County, the concept is far from new.

SolarCity, which is in the process of being acquired by Musk”™s other company, Tesla Motors, will produce the panels at its Buffalo plant.

It marks the entrance for the leading national solar brand into the building-integrated photovoltaics, or BIPV, market, but it won’t be the first company to produce this style of solar.

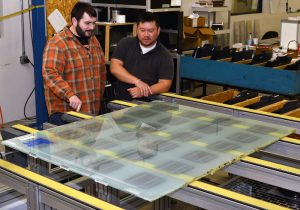

Photo by Bob Rozycki

Atlantis Energy Systems Inc. has been producing BIPV for more than a decade from its 16,000-square-foot manufacturing plant in the town of Poughkeepsie. The company, which was founded in 2002, opened the plant in the Dutchess County town in 2004 after relocating from Virginia.

Atlantis custom manufactures and sells a line of BIPV glass and solar Sunslate roof tiles, mostly to universities, hospitals and large government buildings, with a smaller residential operation as well.

Atlantis”™ line of products includes three different types of slate tiles, slate modules that can combine with a thermal energy system and custom BIPV options such as canopies, skylights, windows and sunshades with solar panels integrated.

Dohn Paditsone, eastern U.S. and in plant sales manager, said BIPV can provide a few advantages. First, aesthetics. The panels are hardly noticeable from ground level, compared with raised, roof-mounted solar panels. You also don”™t have to drill holes into the existing roof to install panels, which Paditsone said can cause leaks and property damage over time. Plus, it can provide a renewable energy source and a new roof for customers who need it.

“Say you have a home ready for a new roof, or you”™re designing and building a new home, then we”™re the guys you want to talk to,” Paditsone said.

The BIPV modules from Atlantis have a 25-year warranty, which is less common among standard solar panel set-ups, according to Phil Germano, the plant manager for Atlantis.

Paditsone said he is waiting to hear more details on what exactly Tesla/SolarCity plans to do with their BIPV products, but he cautioned that it can be a tough market for any company to enter. He pointed out that Dow Chemical Co., for all its Fortune 500 might, entered the market and couldn”™t make it work. The company launched a line of building-integrated solar in 2011 and shut it down in July.

“That’s a well-known company and there”™s plenty of other companies that have tried as well,” Paditsone said.

Building-integrated solar is more expensive, which is part of the difficulty, especially for residential projects. It also generates electricity about 2 percent less efficiently than standard modules.

Paditsone said systems, including installation, can cost up to $8 to $10 per watt, while a standard solar system would come in around $3 per watt. While the usual state and federal tax breaks and incentives still apply, a BIPV system could cost between $30,000 and $50,000 for a residential project, depending on the size of the home. Commercial jobs can ring up in the millions.

“Obviously if you want something to sell, you want to make it available to the general populace, but the problem is the cost just isn”™t there,” Paditsone said. “I can”™t tell you that BIPV will ever be cheaper than standard modules. It”™s not the same product. Because my product is not only giving you free electricity, I”™m giving you roofing as well.”

The company does a mix of international jobs, but Germano said the company does the bulk of its sales in the U.S.

Atlantis has manufactured large projects such as a welcome center in Wyoming, the Alfred A. Arraj U.S. Courthouse in Denver and the Whitehall Ferry Terminal in Manhattan.

Panels are manufactured mostly per order, though Atlantis does keep some panels stocked. Employees at the plant can range from 12 to as high as 46 depending on the project.

The company will look to capitalize on the increased attention SolarCity/Tesla can bring to building-integrated solar. Paditsone said he”™s already seen an increase in phone calls and emails since the announcement, and Germano said he believes Atlantis can offer a wider range of options.

“Thankfully they are only focusing on the roofing tiles, so they haven”™t really moved into where we have our business split half and half, with custom solar windows, skylights and terraces,” he said.

The $2.2 billion deal to merge Tesla and SolarCity is still pending a vote from shareholders.