Residences at malls: An idea whose time has come?

As the leaders and residents of Trumbull deliberate on whether to approve the Westfield Trumbull mall”™s proposal to add luxury apartments to its property, real estate brokers and consultants said that such a move is becoming a more common occurrence in today”™s shifting retail environment.

“Everything is changing and morphing into the new reality,” said Richard Latella, executive managing director of Cushman & Wakefield. “There are cycles involved, and another cycle is happening now, where downtowns are thriving again ”” people are interested in moving to the center of town so businesses are opening there. They”™re listening to what consumers want.”

So too are prudent mall operators, Latella said. “The days of the cookie-cutter mall are gone. The bigger ones, as well as the ones being built, are generally looking to become more of a destination with something to offer beyond just retail.”

Mark Hunter, managing director of retail asset services, the Americas at CBRE, agreed. “What is happening in Connecticut and elsewhere is that retail shopping habits have changed. Some of it has to do with e-commerce, but more of it has to do with omnichannel shopping (allowing consumers to buy through brick-and-mortar stores, online or on social media) and trending towards more experiential-type shopping.”

The two-story, 1.1 million-square-foot Westfield Trumbull, which first opened in 1964, is making efforts at updating its shopping experience both with the traditional (an 11,000-square-foot Ulta Beauty cosmetics and salon, due to open in September) and the nontraditional (a 20,000-square-foot SeaQuest, an interactive aquarium that”™s made inroads at other malls around the country, currently under construction).

But it is its proposal to add 290 apartments to its property at 5065 Main St. that has been the cause of some consternation in Trumbull. To achieve that, the town must grant a zoning change, basically from a mixed-use property to a mixed-use design district.

In May, First Selectman Vicki Tesoro issued a statement assuring residents concerned about traffic, overdevelopment and other issues that her administration was committed to doing right by its residents. “The more Trumbull can control our own destiny, the better we are for it,” she wrote.

Part of the problem, Tesoro told the Business Journal last week, was a lack of transparency from Westfield, whose original proposal for 580 units was quickly shot down. It was only at a July 19 public Planning and Zoning Commission that specifics were provided, including blueprints, she said.

“Showing us their conceptual plans was big,” Tesoro said. “It was important to have something that everyone could actually see. It really went a long way.”

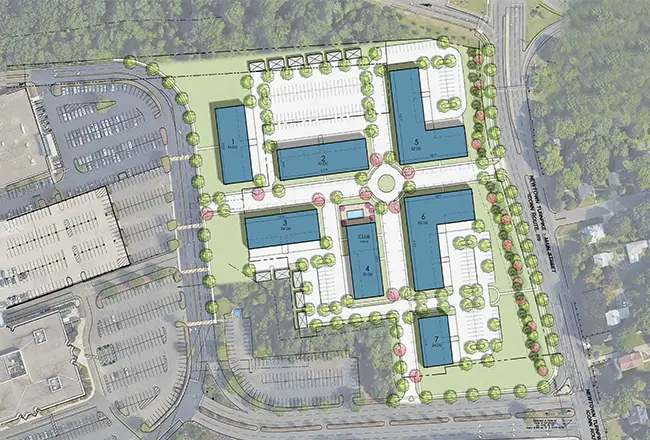

The proposed 290 units would be one- and two-bedroom apartments in seven four-story buildings ”” Westfield emphasized that that could change as the project inevitably evolves on its way to ultimate approval ”” with residents provided an opportunity to rent a garage and/or other storage space. Developers, which include Beverly Hills-based Rose Equities and Short Hills, New Jersey”™s Garden Homes, are also aiming to provide a clubhouse/gym, pool and meeting room.

Westfield representative Stanley Gniazdowski said at the July 19 meeting that the company estimates that upon completion the structures would bring in $601,000 in annual tax revenue. The mall is already the town”™s largest taxpayer, with its 76 acres assessed at more than $209 million and appraised at about $299 million.

“We”™ve been partners with the mall for years,” Tesoro told the Business Journal. “Continuing to have a relationship that works well is better for both of us.”

Economic and Community Development Director Rina Bakalar noted that the next public meeting on the proposal will take place on Aug. 15, with that process scheduled to close by Aug. 25. “If zoning approves, they then have to file a site plan application and then back to zoning,” she said.

For its part, Westfield is already engaged in similar projects around the world. “As the company increasingly incorporates modern residential options into a number of global projects, we aim to create dynamic new communities where people can live, work, dine, be entertained and relax in the same neighborhood,” spokesperson Kate Sirignano said.

Westfield was acquired by Paris-based Unibail-Rodamco last year for $15.7 billion, which has since been “reviewing” its 102 malls worldwide.

“Unibail-Rodamco-Westfield”™s aspiration for the future is not to just remake the modern mall, but to more broadly impact its communities by providing retail, office and residential space ”” all in one place,” Sirignano said. She cited as an example the firm”™s $1.5 billion Promenade 2035 project, which she said will “help create a new downtown for the San Fernando Valley north of Los Angeles.”

That plan would transform the San Fernando Valley”™s Warner Center district into a mixed-use, transit-oriented downtown environment “where new neighborhoods of tree-lined streets lead to vibrant avenues, and where big boulevards are broken up into intimate and accessible neighborhoods,” she said.

But that project too has run into resistance from residents on perceived construction-related air-quality emissions, noise and traffic, as well as over the potential impact of its 15,000-seat entertainment and sports center. That Promenade 2035”™s name includes its proposed completion date indicates how long such transformations can take to complete.

Meanwhile, last month Eatontown, New Jersey officials approved a plan to redevelop its Monmouth Mall that would include the construction of 700 apartments, while the King of Prussia (Pennsylvania) Mall announced late last year plans to build 390 apartments on its property.

Hunter at CBRE said that such mixed uses have been commonplace at European malls for a number of years. “We”™re a little behind, but we”™re catching up with the whole shop-work-live-play movement,” he said. “Today people, especially millennials but also baby boomers, want to live closer to where they work and where they shop than in the past.

“Municipalities that recognize that and work with a shopping center to achieve that will be rewarded,” he continued, “not just by providing a better experience but also by an increase in real estate, sales and payroll tax income.”

Hunter said that CBRE has a “mixed-use strike team” that works with malls and shopping centers around the U.S. to stay relevant in the current ”” and, they hope, future ”” retail environment.

“A lot of it is entertainment-related,” he said. “Today, food and beverage is entertainment. Malls have had movie theaters for years, but now they”™re looking at having bigger screens. SeaQuest and other nontraditional entertainment is becoming much more popular. Over the last 10 years you”™ve seen a number of new upscale bowling concepts like Punch Bowl, Bowl-A-Rama and Lucky Strike arrive.”

Latella at Cushman said that rumors of the death of the shopping mall have been greatly exaggerated. “Today, there are 1,100 to 1,200 malls in the country, which has been the case for the past couple of decades. It hasn”™t really changed significantly. Weaker malls may have been closed down but the better malls are always looking for creative ways to evolve.”

In addition, Latella said reports of the “retail apocalypse” are “overblown. Retail is changing, but it”™s not dying. Someone once said that change is not an option in retail ”” it”™s a job requirement.”

Good news then for the SoNo Collection, the $525 million, 700,000-square-foot megamall in Norwalk scheduled to open in October 2019. Latella said he believed the region”™s demographics could work in its favor.

“You”™ve got solid anchor stores in Nordstrom and Bloomingdale”™s,” which combined will take up over 300,000 square feet, he said. “They”™re making big bets in Norwalk because they”™re not opening a lot of stores otherwise. And they”™re promising another 80 or so stores ”” presumably those will include the kinds of nontraditional attractions we”™ve been talking about.”