Hochul proposes returning $3 billion to NY taxpayers

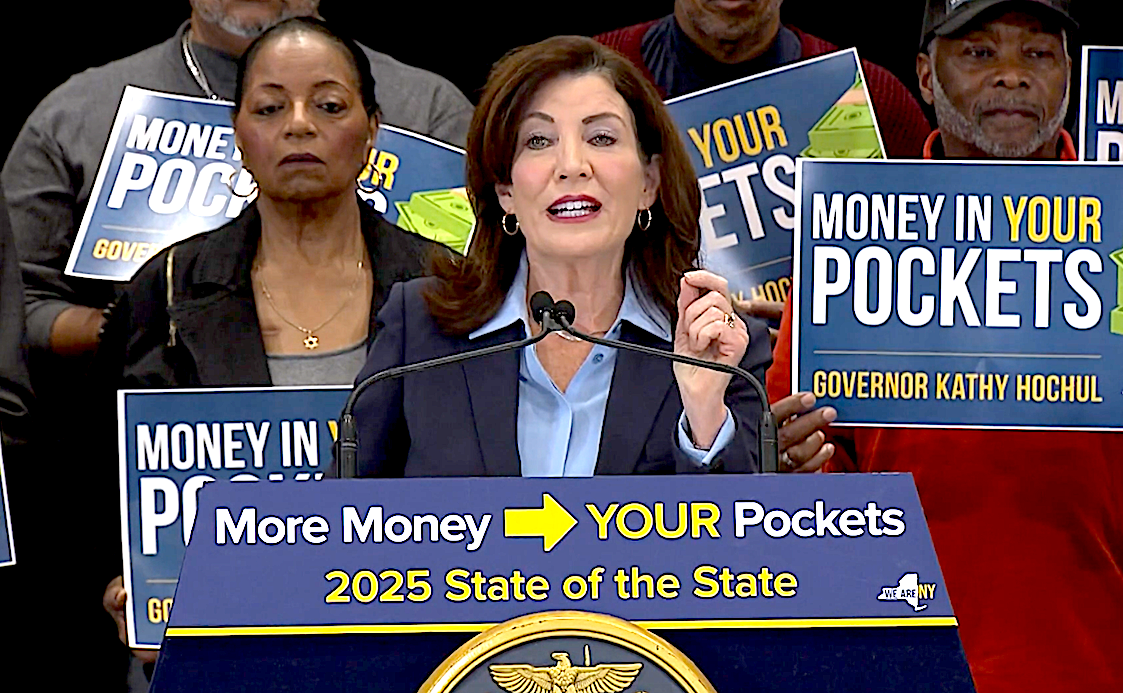

New York Gov. Kathy Hochul today proposed returning to New York taxpayers an extra $3 billion the state collected as a result of inflation. The proposal, due to be included in Hochul’s State of the State Address to be delivered next month in Albany, was revealed during a speech Hochul gave Dec. 9 at Co-Op City in the Bronx.

Hochul’s proposal needs approval by the Legislature and, if approved, checks would not go out until next fall. An estimated 8.6 million New York taxpayers would receive a benefit. Hochul plans to run for another term as governor in 2026.

“Because of inflation, New York has generated unprecedented revenues through the sales tax — now, we’re returning that cash back to middle class families,” Hochul said. “My agenda for the coming year will be laser-focused on putting money back in your pockets.”

A one-time payment of $300 would be sent to taxpayers who are single, head of household, or married filing separately if their income was no greater than $150,000. Resident couples filing jointly would be eligible for a $500 payment if their income was no greater than $300,000.

“Prices go up, more sales tax is collected because the price of everything was up,” Hochul said. “Now I’ll tell you right now, I’m sure there are some elected officials or some special interest groups will weigh in and say, ‘Oh, I know how that extra money should be spent, that one-time extra sales tax revenue spent,’ but here’s my message: I’m on your side. I believe that this extra inflation-driven sales tax revenue shouldn’t be spent by the state. It’s your money, and it should be back in your pockets.”

According to Hochul’s office, there would be an estimated 986,000 recipients of the inflation refunds in the Hudson Valley. An estimated 3,645,000 taxpayers in New York City would receive a payment as would an estimated 1,344,000 taxpayers on Long Island. The number of taxpayers receiving refunds in parts of the state with smaller populations would be proportionally lower.