Patriot banks on growth

Ken Neilson thought he had retired after transforming a small New Jersey bank. A few years later, Stamford-based Patriot National Bank asked him to do it again.

Neilson joined Patriot”™s board in 2010 when the bank”™s parent company, Patriot National Bancorp Inc. took about $50 million in recapitalization after net losses of $7.1 million in 2008 and $23.9 million in 2009. He became Patriot”™s president and CEO three years later.

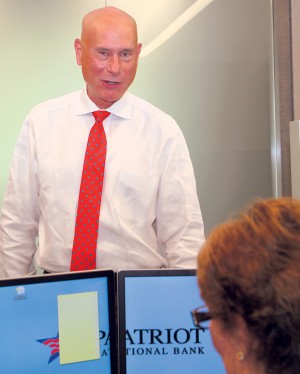

- Patriot National Bank CEO Ken Neilson talks with an employee in his Stamford office. Photo by Danielle Brody

“I enjoyed being on the board of Patriot and was disappointed that the progress we made hadn”™t been faster than it was,” Neilson said. “So when the board asked if I”™d step in and speed things up, I thought it would be fun to get back into the saddle and make a difference.”

In the past few years the Patriot National Bancorp, which is based in Stamford and has 10 branches in Fairfield, New Haven and Westchester counties, has been quietly recovering from the recession.

It has had eight quarters of increasing earnings, according to Neilson.

In July, the bank reported assets of $629 million, an increase from $552 million last June.

In August, Patriot announced private equity firm Castle Creek Capital LLC invested in the bank. That influx will help Patriot with its goal to grow aggressively, Neilson said.

Prior to joining Patriot National, Neilson was the president and CEO of Hudson United Bancrp, based in Mahwah, New Jersey. There, he expanded from 15 branches and about $500 million in assets to more than 200 branches, including in Connecticut and New York, and $9 billion in assets.

Hudson United sold to TD Banknorth for $2 billion in 2006 and Neilson retired.

Joining Patriot National posed a new challenge for the longtime banker. Patriot suffered during the recession, paying off 529 loans totaling $336 million.

In trying to turn things around, Neilson looked at Patriot”™s biggest costs and the bank paid down its high-cost borrowings.

“We were borrowing money at rates higher than we were able to lend it out,” he said.

The turnaround plan also included assessing and renegotiating every contract and reviewing the bank”™s business lines. Patriot stopped residential lending because competitors could be more efficient, Neilson said.

Now at profitability, Patriot is investing in buying its branches”™ buildings. The bank went from paying $350,000 a year for rent in its Greenwich building to buying it and making $150,000 per year net of expenses from the tenants. The bank also purchased its facility in Milford and will do the same in Fairfield. The bank moved its Darien branch to a building it bought and will move the Stamford and Westport branches to purchased buildings.

In another money-saving move, Neilson relocated the corporate offices from Summer Street to Patriot”™s building on Bedford Street.

Neilson said the building blocks to Patriot”™s recovery have been simple, reliable ones.

“It”™s just common-sense business things and analyzing every expense at every opportunity and achieving the base profitability you need to be able to hire the right people,” he said. “That”™s what we”™ve been doing.”

Neilson said he makes an effort to hire local staff that is involved in the community. Loan officers are trained to try to understand more complicated loan applications to help customers.

While he calls small businesses the bank”™s “bread and butter,” he said clients are diversified. The bank does not shy away from nonprofits, which are sometimes seen as risky deals.

Patriot National Bank gave two loans to a nonprofit renovating the 100-year-old Wall Street Theater in Norwalk. After facing rejection from other banks, the nonprofit received a pre-development loan of $500,000 and a $5.2 million loan for construction, said Frank Farricker, a developer with the project.

“They gave us all the money we need to be able to build this project,” Farricker said. “I think it would have been highly unlikely for us to be able to do this without them.”

Neilson said many banks would have rejected the theater”™s application because it looked too risky. Patriot approved the loans because the project was not as risky as it looked and the end result would be good for the community, he said.

As the bank remodels and opens new branches, Neilson said he is keeping in mind they get less foot traffic than in the past. The new facility in Darien will serve as the model ”” it has open space and a community room with teleconferencing capabilities available for customer use.

While Patriot may not be the first bank to roll out new technologies, Neilson said it will not be far behind with those offerings. Soon it will offer ATM machines with an option to speak with a live banker.

Because Patriot only has about 0.1 percent of market share, the bank could grow 10 times over and barely get noticed, but still helps many customers and employees and provides returns to investors, he said.

“We”™re a small-market share player in a large market, so there is a lot of opportunity as we demonstrate the customer service difference between us and other institutions,” Neilson said. “I think there”™s a lot of room for us to grow.”

This article has been updated to reflect that Patriot National Bank had eight quarters of increasing earnings under Neilson’s leadership, not 16.