Key to Savings Bank of Danbury’s 170 years: Community

For any company to last 170 years requires dedication ”“ not just from its leaders but from its employees and customers as well.

In the case of the 170-year-old Savings Bank of Danbury ”“ the oldest continuously operating business in the city of Danbury ”“ it is also dependent upon the communities it serves, according to President and CEO Martin Morgado.

“We have always been a community bank in the truest sense,” he said. “Participation and involvement with the communities within our footprint is one of the most important things we do, and has led to all the success we”™ve had.”

Last year its 200 workers put in 7,000 hours of volunteer service, Morgado said. “Most of our employees are involved in some kind of community service within the first three months of starting to work here.”

He noted 20 employees were volunteering at Ann”™s Place, a local nonprofit that provides services and support to those diagnosed with cancer. Morgado said last year Savings Bank of Danbury worked with 73 nonprofits in the communities it serves via 15 branches, which stretch from its Danbury headquarters as far east as Waterbury and as north as New Milford.

In 2018, the Savings Bank of Danbury Foundation, established in 2004, awarded more than $190,000 to those agencies, a 6% increase over the previous year and the bank contributed an additional $433,000 to various community organizations.

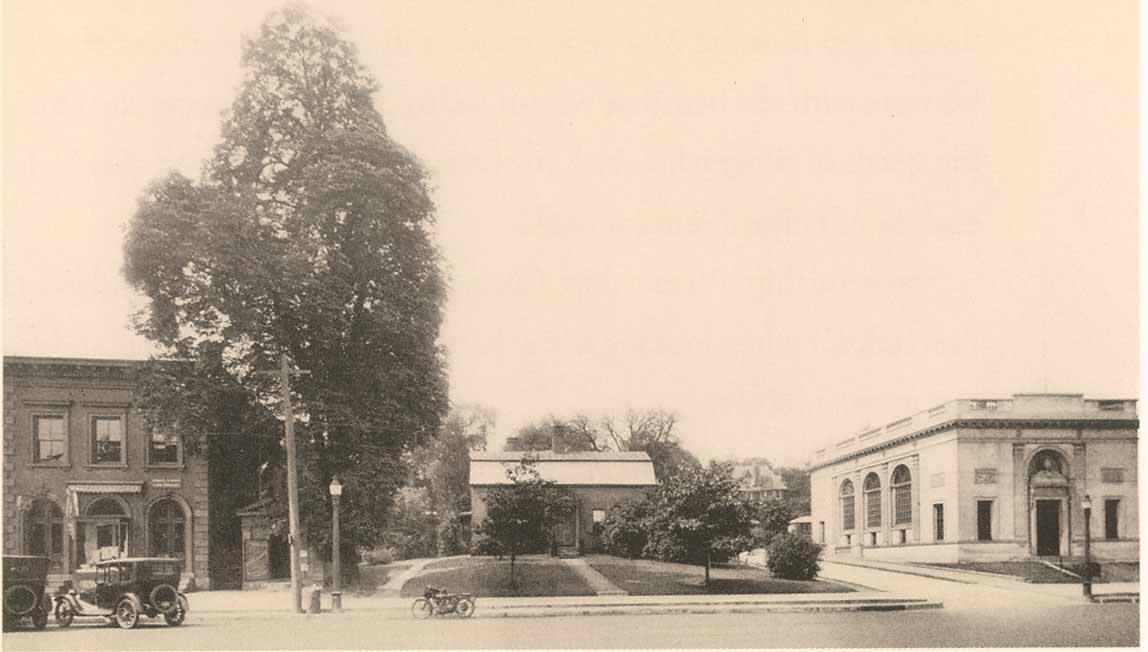

The bank officially opened for business on July 14, 1849, in what is today known as the Ives House. George W. Ives, the father of composer Charles Ives, was its secretary-treasurer from its founding to 1860. Open only on Saturdays from 2 to 5 p.m., legend has it that, should the elder Ives be absent, deposits could be left with his wife at their kitchen door.

On its first day, the bank took in eight deposits totaling $15. Its first year saw total deposits of $12,245.59. Its primary source of business was local home mortgages.

The bank”™s first president was Frederick S. Wildman, a delegate to the Democratic National Convention that in 1828 nominated Andrew Jackson for president, who served in the position for 44 years. Over its first 60 years, the institution grew to three locations, each adjacent to the other.

By 1969, Savings Bank of Danbury had $4 million in cash and U.S. bonds, backed up by $7.5 million in government securities. Although it had limited its operations to savings accounts and local home mortgages for 120 years, it also introduced CDs to depositors that year.

In 1975, the bank had 17 full- and part-time employees ”“ the same number as in 1940, although its savings deposits had grown during that period from $11 million to $77 million. The following year saw the appointment of Florence R. Helley as president, making her the only female savings bank president in the state.

In 1993, the institution expanded with a 6,000-square-foot addition to its 220 Main St. headquarters. Three years later it purchased branch offices in Bethel and Brookfield from Norwalk Savings Society, which was acquired by Summit Bank in 1998.

Morgado joined the bank in 2001 as vice president of retail lending, taking on management responsibility for the mortgage banking division in 2007. His key role in its game-changing acquisition of Stamford Mortgage Co. in 2010 ”“ which had served more than 4,500 households and originated more than $2 billion in residential mortgages since its 1996 inception ”“ helped propel him up the corporate ladder, culminating in his taking the president/CEO role in 2016.

Morgado said he”™d been in the mortgage business well before joining the bank. Having grown Savings Bank”™s mortgage department into a significant presence, and being familiar with Stamford Mortgage as one of its customers, he said the opportunity to acquire it was quickly seized.

“We looked at a lot of other (mortgage companies) that we didn”™t go into partnership with,” he said. “(Stamford founder) Penn Johnson is still president of it, and it”™s become a very profitable part of the bank. Mortgage banking is extremely important to us. It”™s one of our drivers.”

The development and implementation of a new technology platform last year has helped the bank stay on top of the kinds of digital trends that customers are increasingly seeking, Morgado noted. “But we”™re never going to give up on customer service. If you call the bank, you will get a person. I even answer my own phone when it rings.”

Savings Bank of Danbury surpassed the $1 billion mark for assets under management last year, reflecting 9.5% growth. Morgado said the bank will be adding branches this year outside of Danbury, though he declined to provide specifics.

To commemorate its 170th anniversary, the bank is deploying a fleet of vehicles bearing its logo, purchased a float to be featured in local parades and is working with the state”™s Department of Veterans Affairs on various initiatives, including one where schoolchildren will write postcards to those serving overseas. Talks with the Ives House about collaborating on an anniversary-related event are also underway, Morgado said.