In brief

Cengage buys National Geographic unit

Cengage Learning Inc. acquired the National Geographic Society”™s school publishing unit, including related digital properties, and is offering the content under a new brand called National Geographic Learning.

Stamford-based Cengage publishes books and e-learning content for a wide range of settings, including industry, and has partnered with the National Geographic Society since 2007 to produce materials together. The acquisition gives Cengage expanded rights to distribute NGS”™s content to schools and libraries globally, including images, maps, videos and articles.

Nonnatech gets quarters in Stamford

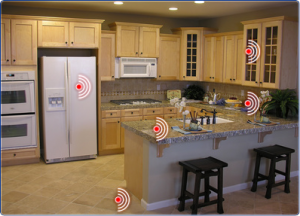

Nonnatech Inc. has opened a Stamford office at 76 Progress Drive, with the startup providing systems to help caregivers monitor elderly people in their homes.

Nonnatech”™s system relies on sensors in living quarters to track events such as temperature changes, wandering and water spillage, among others.

“If seniors start taking more or less medication than prescribed, their daily habits may change,” said Gary German, CEO of Nonnatech, in a prepared statement. “Our system helps family members know if there is a change in sleeping or eating patterns. They will even know if they had an increase in bathroom visits during the day and night, which may be a sign of an issue with medications they are taking, or other problems. The system can decrease the chances of falls by notifying family members of water leaks and having lights turn on automatically.”

Senior home relocating to Bridgeport

Bridgeport”™s Planning and Zoning Commission has approved the relocation of the Jewish Home for the Elderly from Fairfield, with the facility set to move into a Park Avenue building currently occupied by the Jewish Community Center.

According to Mayor Bill Finch, the facility has 300 beds and employs 750 people.

Controller pleads guilty to embezzlement

A New Jersey man admitted he embezzled $85,000 from a Greenwich private equity investment firm where he had worked as a controller.

C. Bradley Simpson, 33. of Wyckoff formerly was controller at Clearview Capital L.L.C. in Greenwich; the office of U.S. Attorney David Fein refused to disclose the identity of the company from which Simpson claimed reimbursement expenses that he had not actually incurred.

Clearview Capital invests in companies with annual revenue of between $4 million and $20 million. In July it acquired Pyramid Healthcare Inc., which provides drug and alcohol counseling and mental health services in Pennsylvania where it is based.

Simpson is scheduled to be sentenced in January, with Fein”™s office recommending up to 21 months in jail and a fine of up to $40,000.

Unregistered businesses pay up

Connecticut collected $1.3 million in penalties from some 330 out-of-state companies that did not register with the Connecticut secretary of state”™s office in the fiscal year ending this past June.

Secretary of State Denise Merrill said it was the largest such figure since 2007, when Connecticut fined companies $1.7 million.

Under state law, businesses must obtain a certificate of authority to transact business in Connecticut by registering and paying a fee, with some 50,000 businesses having done so.

“It is hard enough for Connecticut businesses to make a profit in this economic climate, without unfair competition from out-of-state companies who fail to register with the state,” Merrill said, in a prepared statement. “We have heard from Connecticut companies who are being undercut by outside firms who escape accountability.”

Companies confirm Norwalk deal

Stanley M. Seligson Properties L.L.C. confirmed that it brought in Boston-based Marcus Partners as an investor in three Norwalk office buildings, terming it a deal to “recapitalize” the properties.

The companies did not specify the size of Marcus Partners”™ stake in the buildings. As reported by the Fairfield County Business Journal last month, Marcus Partners invested $19 million in buildings at 520, 605 and 698 West avenues.

Tenants include Norwalk Hospital, which is undertaking renovations as it expands to 22,000 square feet of space there.

Â

Investor money supported racecar team

An Easton investment adviser has pleaded guilty to charges he funneled much of $10 million in client money into a Danbury racecar operation, with some of those funds earmarked for individuals”™ retirement.

Gregory P. Loles, 51, has been detained since the FBI arrested him in late 2009.

According to the office of U.S. Attorney David Fein, Loles took investor money out of an unregistered investment firm he ran called Apeiron Capital Management and used it to support Danbury-based Farnbacher Loles Motor Sports and affiliated entities. Apeiron”™s customers included a church in Orange where Loles sat on an endowment fund. Fein”™s office said Loles lulled investors by periodically making payments, Ponzi-style, from other investors”™ money.

Loles is scheduled to be sentenced in October, with the crimes carrying a penalty of up to 20 years in prison.

Â

Report: State business taxes lowest in nation

A new report ranks Connecticut”™s business taxes as the lowest in the nation, at 3.3 percent of economic activity in the private sector.

The Council on State Taxation study was conducted by Ernst & Young and included corporation business taxes, general sales tax on business input, unemployment insurance taxes, business and license fees and personal income taxes on pass-through business income.

The advocacy group Connecticut Voices for Children said the report provides evidence that the state should not cut corporate taxes in the coming legislative session.

Â

Hedge funds founder again in July

Hedge funds fell 0.1 percent on average in July, according to a global index maintained by Hedge Fund Research Inc., leaving the sector down 2.2 percent for the year.

Fairfield County is a major locus for hedge funds, with prominent local funds including Bridgewater Associates, AQR and SAC Capital.

Among the hedge fund sub indices to finish in the black macro funds fared best with a 1.3 percent gain making investments with an eye on macroeconomic factors such as interest rates and currency fluctuations.