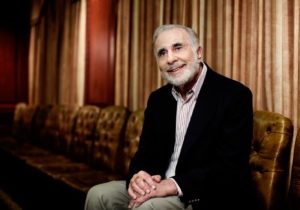

Carl Icahn further solidifies stake in Xerox

For the second time in less than three months, activist investor Carl Icahn has expanded his role as the largest shareholder in Norwalk-headquartered Xerox Holdings Corp.

Reuters is reporting that Icahn raised his stake from 12.82% to roughly 14.4% as of Nov. 5, according to a Schedule 13D filing. Icahn”™s actions were welcomed by investors: Xerox”™s shares quickly rose by 3.4% in extended trading after the news was announced.

In August, the investor”™s Icahn Capital Management acquired 725,935 shares of Xerox ”“ raising his stake from 12.48% to 12.82% ”“ while dumping roughly 63 million shares in HP, worth approximately $1.1 billion.

Earlier in the year, Icahn acquired a 4.2% share in HP when Xerox was attempting a hostile takeover of the company. He also briefly raised the possibility that he would buy HP directly if Xerox could not close the deal, but Xerox abruptly ended its pursuit of HP when the Covid-19 pandemic disrupted the economy.